Have you ever wondered why your statement of account is so important? As it is your financial footprint, it is quite important to access it and keep checking every now and then.

Having a glimpse of your financial history is a good thing for effective personal financial management. You would know exactly what is going on with your bank account and what your bank is offering you for keeping funds with them.

It might help you control the inflows and outflows of the current fund in your account. It also gives you proper insight into the various charges and fees banks usually levy.

A statement of account is the reflection of all your financial transactions that took place between you and any other person or entity for a given period of time.

You can get it monthly or on any other specified date as you wish. Generally, a statement of account is necessary for confirmation of any transaction made to or by you. For business purposes, it is used quite often for confirmation of transactions.

How do I read statements of account?

It’s quite simple if you know the basics of accounting. What is reflected in the statement of accounts are:

- Date of transaction

- Value date

- Description

- Reference number

- Debit column

- Credit column and

- Balance

Date of transaction

Normally, the date of the transaction and the value date are the same. It’s the date on which you made the transaction.

Description

Details of your transactions will be reflected in this column.

Reference number

All sorts of reference numbers particular to a transaction will be reflected in this column. Besides this, the cheque number will also be reflected here.

Debit column

Whatever funds go out of your account will be reflected here in this column. It means all sorts of payments. It may be paying to your friend’s account, grocery bills, fuel refills, etc.

Credit column

Whatever payment you receive will be reflected here. It includes your salary, someone paying you, money received for the sale of goods, etc.

Balance

It is the actual amount available in your account.

This article will briefly discuss the importance of the account statement for any account you have. It may be a savings Bank account or a business current account.

Uses of the Account Statement

Other than just routine verification of financial history, there are a number of personal tasks that require your statement of account. These tasks would not be completed without them. It includes

- For getting a foreign passport.

- For tax filing.

- For getting a loan.

- checking account history.

- Finding the bank’s levied charges

Importance of self-verification.

Once in a while, it is recommended to check your statement of account. It has a lot of benefits if you regularly keep track. Its benefits are listed below

- It helps with tracking and controlling your fund flow.

- You might be able to know what the bank charges you for keeping funds with them.

- Excess deductions, if done, can be verified and complaints raised accordingly.

- It keeps records of all your financial dealings.

- It is evidence that can be produced in court.

How do I get a statement of account?

Long before digital banking was not so prominent, we used to get account statements only in the printed papers. And yes, before that, it was quite a different scenario. Your statement of account would be given by hand or by post.

Now, things have changed. Digital banking makes it very convenient for everyone. All sorts of financial dealings are at your fingertips. It’s just one step away from mobile banking applications such as SBI YONO, Axis Mobile, iMobile etc.

Both savings and current accounts can be accessed through Internet banking too and you can download them in PDF format as well as in Excel format.

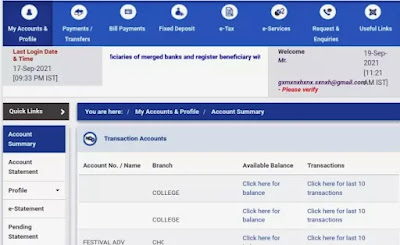

All banks have somewhat similar options. You would get it on the login landing page under quick links or under the My Account section. Like for example, the State Bank of India’s net banking menu does look like this.

Either way, it would work and you should get your account statement without any problem.

Options of getting it.

There are 4 options to get a statement of account. These are as follows

- You can use the mobile banking app to access and download your account statement. SBI has YONO and ICICI has iMobile.

- You can visit the bank’s official website and download it through the web portal internet banking.

- If you are not comfortable with the above, you may visit the branch to get the printout.

- You may request your bank to send you by mail or email every month.

Conclusion

Statement of account, it may be for a savings Bank account or business current account. Irrespective of the type of account, it is a very important document. It helps us in knowing so many details of our financial dealing as well as one’s history of financial status.

Getting it for our own purpose is quite simple nowadays. All you need is a mobile banking app or if you have bank internet banking. You can download it at your convenience.

Making your own archive for a statement of account would definitely ease your personal financial management. Be it a digital archival system or just filing it up would do the trick.

Outstanding blog site! I am amazed with pointers of writer. Banking in Rural India

That is a great tip particularly to those fresh to the blogosphere. Brief but very accurate information… Thanks for sharing this one. A must read post!

Your style is unique in comparison to other people I’ve read stuff from. I appreciate you for posting when you’ve got the opportunity, Guess I’ll just book mark this blog.

Good post! We will be linking to this particularly great post on our website. Keep up the good writing.

Nice post. I learn something new and challenging on websites I stumbleupon every day. It will always be exciting to read through content from other writers and use a little something from their websites.

Hello my friend! I wish to say that this article is awesome, nice written and include almost all vital infos. I’d like to see more posts like this.

Impressive insights, thanks for sharing this valuable information.