Pehla Kadam and Pehli Udaan, a savings bank account for kids. A special product of the State Bank of India aims to inculcate the habit of saving among children.

Teaching our kids about financial products is as important as any other field that we let them learn about.

Introduce them to some basic needs, like a savings bank account, for instance, by letting them learn to fill out an account opening form, how to save money, and how to make deposits into and withdrawals from the account. These would let your kids know the value of money.

While the guardian will be the primary operator of this account, the bank has established certain criteria that would allow a minor to operate the account in specific circumstances.

The criteria are that he should be over 10 years of age and be able to sign uniformly in a legit manner. Otherwise, the account will be operated by the guardian.

Why it’s so important?

In today’s digital age, when all sorts of payments related to school are done account payee only. Having kids’ bank accounts has become a necessity.

Moreover, there are certain payments you cannot receive in your bank account. The payment proceeds have to go to the child’s account specifically. For instance, payment such as scholarship awards.

These are the reasons why you should open Savings Bank account in your child’s name.

- For getting scholarship payments

- Applying online application

- Fund transfer

- Investment in child’s name

- And for health insurance

It means certain things can not be done only with the guardian’s account. Sooner it will create problems for not having your children a bank account.

So, reach out to your nearest SBI branch and get Pehla Kadam and Pehli Udaan accounts for your kids. Here’s a glimpse of these minors’ savings bank accounts.

Pehla Kadam SBI Savings Bank Account

It means “First Step”. Like a parent guiding a newborn to walk for the first time, SBI is lending hands for the kids to take their first step in the banking world.

With the help of the Pelha Kadam account, kids will be able to operate the account and do some limited transactions with their guardians. A guardian may be a natural or legally appointed guardian.

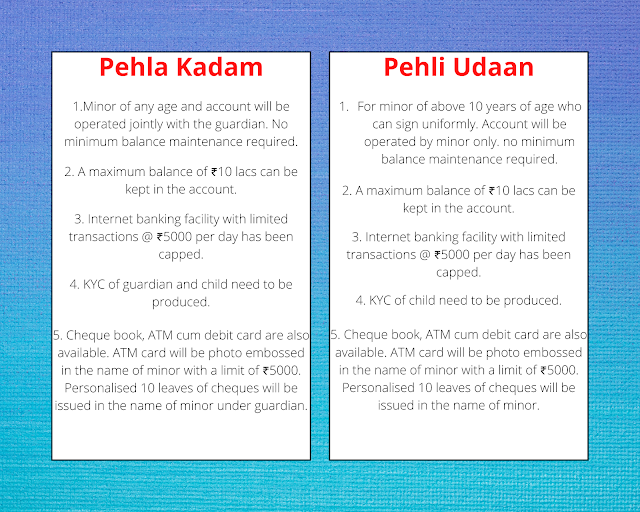

This account is for children of any age; the account will be opened jointly with the guardian.

Some of the important facilities that come along with the account are as follows:

- Chequebook: A personalized cheque for 10 leaves will be issued in the name of the minor under the guardian. A guardian’s signature is required to withdraw cash by cheque.

- Internet banking: Internet banking with limited transaction rights will be given to the minor. The transaction limit is set at ₹5000 per day.

- ATM cum debit card: A photo-embedded ATM cum debit card will be issued in the name of the minor and guardian. This card has limited transactions at the ATM as well as at the PoS-point of sale, which is ₹5000.

- Auto Sweep: An auto sweep facility is also provided. An auto sweep is a kind of transaction where an internal fixed deposit account is opened automatically when it reaches the threshold limit of ₹10000. The access amount will be pushed internally to create a fixed deposit, which would offer options to earn handsome returns.

- The sweep will be in multiples of ₹1000 where the minimum sweep amount is ₹10000.

- An Overdraft against FD can be availed of under the Pehla Kadam account.

Pehli Udaan SBI Savings Bank Account.

As the name suggests, it’s the first flight with confidence.

Both of these accounts are almost the same; the only difference is in the operation of the account. In the Pehli Udaan account, the minor will operate solely in his name without his guardian.

The account is for those minors who are above 10 years of age and can sign uniformly in a legit manner.

The facility given in this account is just the same as that of Pehla Kadam. The only variation is that in the Pehli Udaan account, the photo-embossed ATM debit card will be in the name of the minor only. A chequebook will also be issued in the name of minors only. The rest are the same for both types of accounts.

Now is the time to start letting your kids venture out and learn new things about financial products. As we go digital, it has become pertinent to let your kids know about these basic things, which will catapult their understanding in the future for their own better financial knowledge.

We are in a country, where financial literacy is very poor, and it is our responsibility to learn and let our children learn at an early age so that we can contribute on a larger scale to our community and ultimately to the nation.

Expose yourself to various financial products, not necessarily to buy them all, but try to know what’s in them and teach it to the younger ones, who would be the pillars of our community.

So guys! Go get an account and start saving for a better future. For more details, please check out the SBI’s official website.

Nice post. I learn something totally new and challenging on blogs I stumbleupon on a daily basis. It’s always exciting to read through articles from other writers and use a little something from other web sites.

You need to take part in a contest for one of the finest websites online. I will recommend this site!

A motivating discussion is definitely worth comment. I do believe that you ought to publish more about this issue, it may not be a taboo subject but generally people don’t talk about such topics. To the next! All the best!!

Hello there, I do think your site could possibly be having browser compatibility issues. Whenever I look at your site in Safari, it looks fine however when opening in I.E., it has some overlapping issues. I simply wanted to provide you with a quick heads up! Besides that, fantastic site!