Have you ever come across a Mode of Operation while opening a new account?

It can be a savings bank account or a current account. The mode of Operation in a bank account is a necessity that every account holder has to declare.

It enables you to access your bank account in various ways.

A bank account can take many forms: a single account, joint account, business account, company account, government account, etc.

The mode of operation gives a mandate on how these accounts will be operated.

What Is the Mode of Operation?

It is a mandate you give when opening a bank account.

It can be any sort of bank account, savings account, or business account.

Executing the mode of operation in a bank account, lets you pick the means to access and operate the account.

It is quite common in normal banking transactions, and it is essential too. Without giving a proper mandate to your bank, they may not allow you to operate your account. It may sound weird, but it’s essential for the bank account to run smoothly.

You might find different ways to do it. For example, An account in a single name usually has a single operator by default, and an account in a joint name has multiple account operators. That’s where the mode of operation comes in.

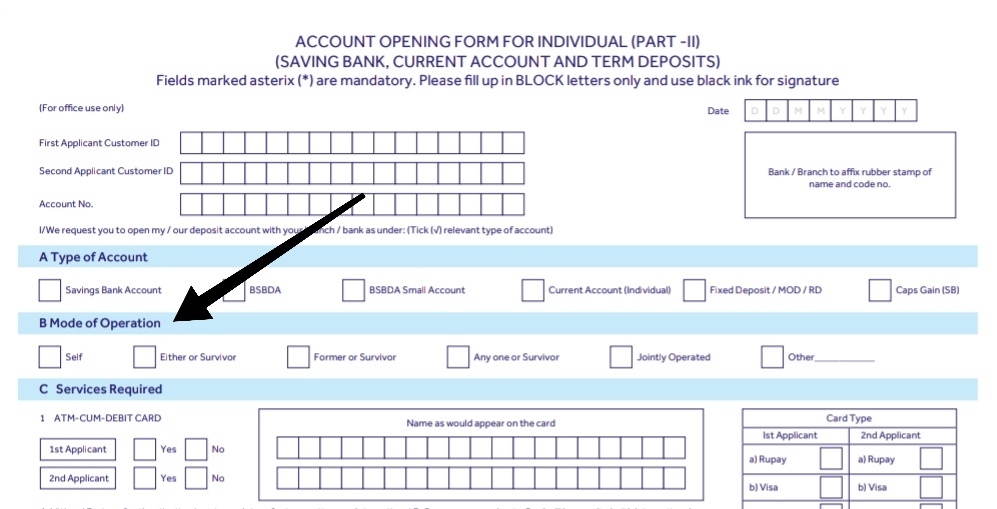

Below is a part of the account opening form. You may find a section where you need to select the mode of operation when opening a bank account.

Types of Mode of Operation in a Bank Account

As the name suggests, it describes how your account will be operated and by whom.

When you are about to select your choice, you will see these options.

| 1 | Single/Self |

| 2 | Jointly Operated |

| 3 | Either or Survivor |

| 4 | Former or Survivor |

| 5 | Anyone or Survivor |

| 6 | Jointly or Survivor |

| 7 | Latter or Survivor |

| 8 | Power of Attorney |

Your savings bank account probably has a single mode of operation. When you add or join another person in your account, it becomes a joint account that can be operated according to what you have mandated with the bank.

There are other types of accounts that are in the nature of joint operations. It can be a government departmental account or a society account. These accounts need a specific mode of operation. Without it, account operations are impossible.

The common types of operations listed above can be easily executed when filling out the account opening form. Whenever there is a change in the organization about the terms and conditions of operating the account. You should contact the bank and update accordingly to avoid rejection of the account operation.

Single or Self

It is meant for a savings bank or current account that is in a single name. It is also applicable to a safe deposit locker account.

Cheques will be signed by the account holder himself. A proprietorship’s current account will be under a single operation.

Other than cheques, any amendment request in the account, such as an ATM card request, chequebook applications, KYC updates, etc., will be signed by the account holder only.

Jointly Operated Account

In a jointly operated account, the mode of operation is shared by all the account holders. They are required to sign all the financial and non-financial transactions in the account.

A savings bank account can be operated jointly amongst family members, amongst friends, or non-personal savings bank accounts such as government accounts, departmental accounts, etc.

Whereas current accounts such as partnership firms, company accounts, trust accounts, etc. are normally operated jointly.

Either or Survivor

‘E or S’ is a kind of Mode of operation where either can sign to do financial as well as non-financial transactions.

When Mr. A and Mrs. A have a joint account with the “Either or Survivorship” clause, they can operate the account with any of them.

When it is ‘E or S’, there is no need to appoint a nominee to the account. If anyone dies, the Survivor can continue the account. This applies to savings bank accounts and safe deposit locker accounts.

Former or Survivor

In the ‘F or S’ type of mode of operation, the former will operate the account as long as he is alive.

When he expires, the Survivor becomes active and continues using the account.

Account open in the names of the father and the son. Father is the primary account holder- Former will continue operating the account. When he expires, the son, who is a secondary account holder, will continue using the account.

Anyone or Survivor

This one is somewhat similar to ‘E or S’. In ‘E or S’ there are only two people involved.

Whereas in the Anyone or Survivorship account, there can be more than two people.

Anyone can operate the account. If a person is deceased, the survivors will continue using the account.

Jointly or Survivor

If any of the account operators/holders dies, the account will be operated together by the remaining operators with the survivorship clause in place.

Later or Survivor

The Latter or Survivorship clause works just opposite the Former or Survivorship clause.

Here, the latter operates the account as long as he is alive.

The other party will be entitled to the rights only when the latter expires.

Bank Account Operated Under Power of Attorney

The operation of the account will be determined by the account holder/holders. A single person can be allowed to operate the account in their favour.

The appointee may get transaction rights such as cash deposit, withdrawal and fund transfers. But he will not be entitled to make changes in account details.

This sort of mode of operation is seen mostly in company accounts and other governmental accounts. The organisation appoint one of its employees to represent in favour of them. He is given certain limited rights to operate the account.

To make it happen, a Power of Attorney has to be executed in which the terms of using the account are clearly mentioned.

How to Change Mode of Operation in Bank Account?

The account operation can be set as per your need. Earlier you have chosen ‘Either of Survivor’ as an account mandate.

Now when you want to change to other forms of operation, can it be done? Yes, you can do so…

There is a simple format for that. Just fill out the form and submit it to the bank. Your bank may ask the reason which you have to provide but there should be consent from all the account holders. It is simple to change it when it is a family joint account where getting signs of each user is easy.

On the other hand, it is quite difficult for an organisation account. It would take board members to make fresh resolutions and make changes to certain other things. However, at the end of the day, it can be done.

Of all the Mode of Operations, it is clear how important it is to mandate the bank about how the account will be operated. If not properly, the operation will be jointly by default if it’s a joint account and single if it’s in a Single name.

So go ahead and check once more if your account is properly updated with the exact mode of operations you want. Otherwise, it’s kind of frustrating when banks deny you to access your own account.

This article provided me with a wealth of information. The article is both educational and helpful. Thank you for providing this information Capital Savings Bank. Keep up the good work.

Very good information

I just need to say this is a well-informed article which you have shared here about topic. sme working capital loan It is an engaging and gainful article for us. Continue imparting this sort of info, Thanks to you.

Thanks for sharing your info. I really appreciate your

efforts and I am waiting for your further post thanks once again.

Feel free to surf to my homepage :: how to buy followers on tiktok for free

I truly appreciate this blog article.Really looking forward to read more. Keep writing.

There’s certainly a great deal to know about this topic. I love all of the points you have made.

A big thank you for your blog. Want more.

Appreciate you sharing, great article post. Much obliged.

I truly appreciate this article.Thanks Again. Awesome.

Great, thanks for sharing this article post.Really thank you! Fantastic.

Hello my friend! I wish to say that this post is amazing, great written and include approximately all important infos. I’d like to look extra posts like this .

I really enjoy the blog post.Much thanks again.

Hi there! I’m at work browsing your blog from my newapple iphone! Just wanted to say I love reading your blog andlook forward to all your posts! Keep up the outstandingwork!

I¡¦m no longer sure the place you’re getting your info, however great topic. I needs to spend some time finding out more or understanding more. Thanks for great info I was searching for this info for my mission.

Hey there, You have done a fantastic job. I’ll certainly digg it and personally

suggest to my friends. I am sure they’ll be benefited from

this website.

Feel free to visit my web page keberhasilan okr

I value the article.Thanks Again.

Really enjoyed this article post.Really looking forward to read more. Great.

I’m no longer sure where you’re getting your information, however great topic.I needs to spend some time learning much more or understanding more.Thanks for wonderful information I used to be in search of this information for my mission.

These are truly great ideas in on the topic of blogging.You have touched some fastidious points here. Any way keep up wrinting.

I enjoyed your post. Thank you. Nice write up. I truly appreciate this post. Thumbs up!

There’s certainly a great deal to know about this subject.I really like all of the points you’ve made.

Wow, great article post.Really thank you! Keep writing.

I cannot thank you enough for the blog.Really looking forward to read more. Much obliged.