Yes, you can extend your PPF account for a term of 5 years if you want to. Extension of the PPF account is quite easy. It has to do within a year of your account is expired.

In this article, we will go through some of the basics of PPF account extension. How a PPF account can be extended when it’s matured? We have got you covered all the details here on this page, read on.

Before we do that, let us understand a few basics of a PPF account.

What is a PPF account?

PPF account stands for Public Provident Fund account. It is a provident fund account that can be opened by an Indian individual irrespective of age and gender.

Foreign nationals and NRIs are not eligible for this account.

This account provides the facility of tax exemption under section 88 of the Income tax act. In fact, one of the most effective tools for tax exemption used by every Indian citizen and it is quite easy to handle.

You can deposit multiple times in a financial year. The maximum deposit amount is capped at ₹1.5 lacs every financial year.

One person can have only one PPF account. Minor can have this account but the parent will have to operate the account in favour of the minor.

| Product Name | Public Provident Fund A/c |

|---|---|

| Account type | Govt. Sponsored Deposit Account |

| Interest Rate | Govt. Rates presently 7.10 pa with effect from 01.04.2020 |

| Tenor | 15 Years |

| Premature Closure | Not Applicable |

| Extension | Available on multiple occasions |

| Withdrawal | Eligible only after 5th Financial Year |

| Deposit Amount | Max ₹1.5 lacs per Financial Year |

| No. of Deposits | Multiple times |

Closure of the PPF account

You can not close a PPF account before its maturity. Account has to close only when its term is completed.

Premature closure of the PPF account is permitted under the following conditions.

| 1 | If the depositor is expired, the account will be closed and paid to the nominee. |

| 2 | The depositor has contracted or has a life-threatening disease. |

| 3 | For higher studies of children. |

How to Extend PPF Account in SBI

PPF account can be extended for a term of 5 years. Extension letter to be served to your bank within one year of maturity of the account. When this period of 1-year lapses, you would not be able to extend your SBI PPF account but close it.

You can visit the bank and submit form-H to extend your PPF account in SBI.

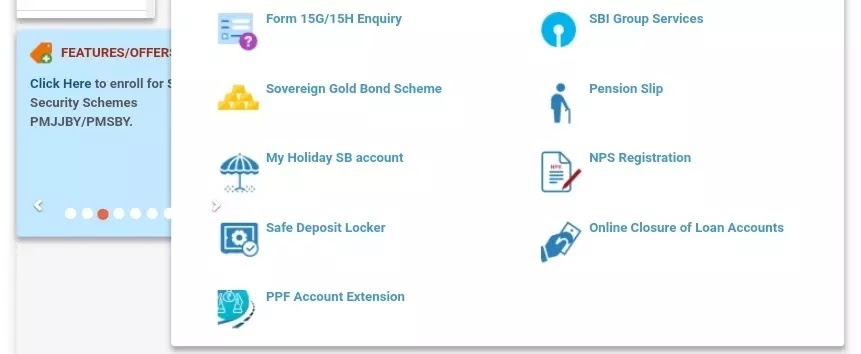

You can also use SBI Internet banking for the PPF account extension. SBI provides the facility of PPF account extension in their Internet Banking platform. Here’s what you need to do-

The above page is the e-service section of SBI Internet banking. When you login to the bank’s official website https://onlinesbi.com you will find the above menu.

Click on the menu PPF Account Extension. Provide the details and submit it. Your request for a PPF account extension will be completed on the spot. SBI PPF account extension can be done manually by visiting the branch with form-H.

Choose as per your convenience and proceed accordingly.

How to withdraw money

Withdrawal of funds from the PPF account will be as per the terms and conditions of the product. These terms and conditions are applicable to all the financial institutes and banks that have the licence to provide the PPF account facility.

Basically, you will be able to withdraw funds on the completion of the 5th financial year. It will be counted from the day you open the provident fund account.

The exact withdrawable amount can be seen on your internet banking or your bank may be able to provide you with the details.

As per the scheme, you will be entitled to withdraw 50% of the deposit amount.

For withdrawal use, form-C and the amount will be credited to your savings Bank account.

Top 6 Benefits of SBI PPF Account

| 1 | A stable rate of returns with decent interest rates is set by the government every quarter. |

| 2 | Tax exemption benefit is one of its best qualities. You can get both the principal amount as well as the interest earned exempted for TDS and other taxes under Section 88 of the Income Tax Act. |

| 3 | The scheme can be invested by any Indian national irrespective of age and gender, but one person can have one PPF account. Provision is that, when you open a PPF account for a minor, there should be a guardian to operate the account in favour of the minor. |

| 4 | A demand loan is available against the deposit amount with a much low-interest rate. |

| 5 | The PPF account can be transferred within branches of SBI. You can also transfer the account to other banks and post offices too. |

| 6 | A nomination facility is available and you can make multiple persons as nominees with a provision to allocate shares of the nominees. Nomination can be done online as well as offline by visiting the bank. |

Conclusion

PPF account is a must-have account for every individual irrespective of one’s earning capacity. You can invest on a monthly basis or deposit to the account once in a financial year. As low as ₹500 you can choose for the subscription but the maximum amount cannot go beyond ₹1.5 lakhs.

It gives security on your investment along with tax benefits as well. At the end of the day, it will give you better savings with zero risk involved.

The other thing is not only in a nationalised bank, but you may also be able to open an account in Post Office.

For more details on the PPF account please visit National Savings Institute India.