What is the SBI FASTag?

SBI FASTag is a 10×5 cm, multilayered, rectangle-shaped piece of good-quality paper with a chip and antenna inside its layers.

SBI FASTag uses Radio Frequency Identification technology for making toll payments directly from the prepaid account or linked savings bank account.

It is posted on the vehicle windscreen and enables the automatic deduction of toll charges while driving through toll plazas.

It provides convenience and ease during transit through toll plazas across the country.

How does SBI FASTag work?

SBI FASTag is linked to your prepaid account or savings bank account. The tag has a chip and antenna inside it. The tag reader at toll plazas uses RFID technology to read users’ details and initiate autopayment while passing through all toll plazas.

Applicable charges will be automatically debited from your prepaid account or linked savings bank account.

SBI FASTag comes in two categories

The State Bank of India offers FASTag in two categories. Either way, you can opt to have one.

Limited KYC holders account, where at any point in time you cannot have more than ₹10000 at your FASTag account, and the monthly limit is also capped at ₹10000.

Full KYC holder’s account, where at any given point in time you cannot have more than ₹1 lakh in your FASTag account. There is no monthly reload cap.

Facilities of SBI FASTag

SBI FASTag really makes things way simpler and better when you are on a road trip. Here are its features:

| 1 | HASSLE-FREE PAYMENTS As you pass by toll plazas, auto-debit of toll fees through the SBI fASTag account makes for smoother and faster transit and saves time. |

| 2 | CONVENIENCE Users need not worry about carrying hard cash as SBI FASTag is totally cashless transaction. |

| 3 | EASY RECHARGE Reloading the SBI FASTag is easy. It can be done online through credit card, debit card, internet banking, IMPS, Google Pay, and Paytm. It’s all there for you. |

| 4 | SMS NOTIFICATION Whatever transaction your FASTag makes, there will always be an instant notification delivered to your registered mobile number. |

How do I get a SBI FASTag?

Getting an SBI FASTag is very simple, and the services given by the agent are also quite satisfactory.

If you need to install and open an SBI FASTag account, follow these few steps below

| 1 | Call the SBI FASTag helpline at 1800110018 or check the bank’s website for the list of Point of Sale(PoS)/agents. Location wise list of agents has been provided on their official website. |

| 2 | When you get the location of your nearest PoS/Agent, visit them with the required documents. |

| 3 | Fill out the application form and submit it along with your KYC documents and vehicle registration number. |

| 4 | After your account is successfully created, the SBI FASTag agent will affix the FASTag to your vehicle’s windscreen. |

| 5 | You will also receive an SMS with the credential details of your SBI FASTag account, which will help you log in to the SBI FASTag website to manage your account. |

Required documents for SBI FASTag account creation.

| 1 | KYC documents, your identification card can be an Aadhaar card, Driver’s license, Voter card, passport, or PAN card. KYC will be as per the Reserve Bank’s guidelines. |

| 2 | Passport-size photographs of the vehicle owner. |

| 3 | Registration Certificate of the vehicle. |

| 4 | A duly filled-up SBI FASTag application form. |

How do I check the balance of the SBI FASTag?

You can check your SBI FASTag account in many ways. We will discuss them one by one.

SBI FASTag account balance Check using the SBI FASTag web portal.

Open the internet browser and log on to the FASTag website. View the FASTag balance. You can also download the FASTag application available at the Google Playstore to view the balance and other facilities.

SBI FASTag account balance Check using SMS.

Balances are normally notified to the registered mobile number of the end user whenever there is a transaction.

SBI FASTag account balance Check through the Customer Care Helpline.

You can call the SBI Customer Care helpline at 1800110018 to know your current account balance.

Charges of using SBI FASTag

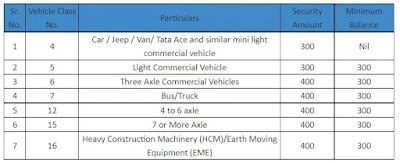

State Bank of India will charge you an issuance fee of SBI FASTag, which is ₹100 for all categories of vehicles. Other than this, there will be a minimum security deposit, which varies as per vehicle type.

You may refer to the table below to find out what your minimum security deposit would be. This security deposit will be refunded to you when you close your SBI FASTag account.

How do I recharge my SBI Fastag Online?

SBI Fastag accounts can be recharged in multiple ways. You may use applications other than those provided by the bank.

For instance, you can use applications such as Freecharge, Paytm, Google Pay and Phonepe. We will focus mainly on the SBI online processes.

How to Recharge SBI Fastag on Fastag site

Here’s how you can proceed:

| 1 | Visit the SBI Fastag website https://fastag.onlinesbi.com |

| 2 | Use your credential to access the portal |

| 3 | Select the Tag Recharge menu from the page |

| 4 | Provide the amount that you want to recharge |

| 5 | Click the Pay Now button and select the payment method. You can use payment methods such as net banking, card payments, and UPI payments. |

| 6 | Confirm the details and proceed further to complete the transaction. |

How to Recharge SBI Fastag on SBI YONO

You can follow these steps to recharge Fastag with SBI YONO. If you have not used the SBI YONO service, get it installed on your phone and proceed accordingly.

Here’s how you go about it.

| 1 | Login to SBI YONO or register for SBI YONO if you are a new user. |

| 2 | Choose the YONO Pay option available on the main screen. |

| 3 | Under the Quick Payments menu, you will find the Fastag payment option. |

| 4 | You can use the UPI facility to recharge your Fastag account. |

Clearly, It is an engaging article for us which you have provided here about Capital Security Bank Limited This is a great resource to enhance knowledge about it. Thank you.