Everybody should know how to block ATM cards instantly, irrespective of the bank. We will discuss why it’s essential to understand ATM card blocking.

These days, fraudsters are everywhere, and sometimes we unknowingly compromise our ATM card details, believing these fraudsters are trying to help us.

There are a lot of ways we could end up compromising our card details. It can be card skimming, phishing, or pharming. Besides these techniques that fraudsters use to steal sensitive data, social engineering is an emerging technique to defraud people.

But if such an incidence occurs, our basic instinct is to stop or prevent the damage. The only way to save ourselves is to block the ATM card instantly, which would prevent further damage to the account linked with the card.

An ATM card is a plastic card that allows you to withdraw money from an ATM machine. Whereas a debit card is an upgraded version of ATM card that has other functionality such as online transaction facility. At present, banks normally issue ATM debit card to its consumers.

The Basics of ATM Card

Every ATM card has a specific number assigned to it, which is called an ATM card number. Its digits differ from bank to bank. SBI has 16 digits, and other banks in India may have 14 to 16 digits.

This card number is required while making online purchases and other transactions such as bill payments, fee payments, etc.

On the back side of your card, you will see a 3-digit code written in a box; it’s your ATM card CVV number. It means Card Verification Value.

This CVV is required for the completion of your transaction if you pay online rather than swiping your card at outlets such as shopping malls or any other vendors where the POS machine is installed.

So altogether, there are three main things that are required for online purchases and payments. Your card number, card expiry date, and CVV number.

When you use your ATM card at the ATM or at a POS, you may only need to punch your ATM PIN. These channels are safer, as the transaction is under your control.

But when you use the card for online payments, besides checking the authenticity of the website you are dealing with, you have to safeguard those three card details at any cost.

When you compromise, knowingly or unknowingly, you are exposed to a huge financial risk that may involve the loss of funds from your bank account.

How to Block SBI ATM Card

SBI ATM cards can be blocked in many ways. The State Bank of India has given four options for blocking ATM cards. You may use any one of these when unwanted things happen to you.

- By sending an SMS from your registered mobile number.

- Through Internet banking.

- By calling the customer helpline.

- By visiting any nearby SBI branch.

Awesome right? It means you do not have to worry at all if you have lost or stolen your ATM card. Even when you have doubts about your data integrity, you can instantly block your ATM card to avoid substantial financial loss.

1. Blocking SBI ATM cards by SMS

You can block your ATM card easily by sending a message from the registered mobile number. Send by writing “BLOCK<Space>XXXX to 567676 where XXXX stands for the last 4 digits of your ATM card.

Once it’s done, you will get a confirmatory message that contains the ticket number and time of card blocking.

2. Blocking through Internet banking

There are actually 3 ways you can go about it. SBI has 3 platforms for Internet banking. These are as follows:

- Through SBI YONO Lite (Mobile Banking),

- Through SBI YONO (Internet Banking on Mobile Platform),

- And through the web version of Internet banking.

How to Block SBI ATM Cards on SBI YONO Lite

Go to the Google Playstore or iOS and download SBI YONO Lite.

If you are already using the service, login and proceed.

If you are new to this, you have to register for SBI YONO Lite with an Internet Banking credential.

It’s a one-time process authenticated with an OTP.

Complete the registration and follow these steps to block the card instantly.

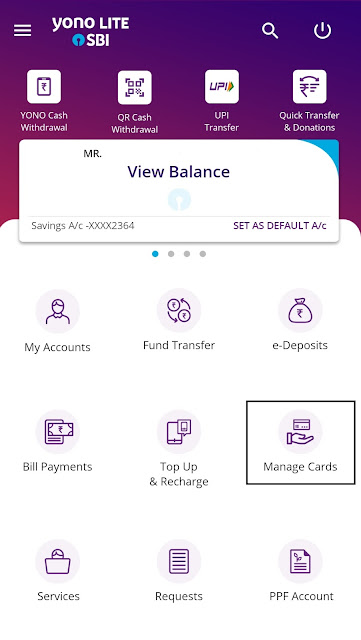

- Log in to SBI YONO lite.

- You will see the “Manage Cards Menu” on the main screen.

- Click on the “Manage Cards Menu,” and you will be guided to the next screen where you can hotlist your ATM card.

- Select the account number and card to be blocked, and confirm.

How to Block SBI ATM Cards on SBI YONO

Go to the Google Playstore or iOS and download SBI YONO.

If you are already using the service, login and proceed.

For first-time users, you have to register SBI YONO on your phone with an Internet Banking credential.

The process is one-time and authenticated with an OTP.

Complete the registration and follow these steps to block the card instantly.

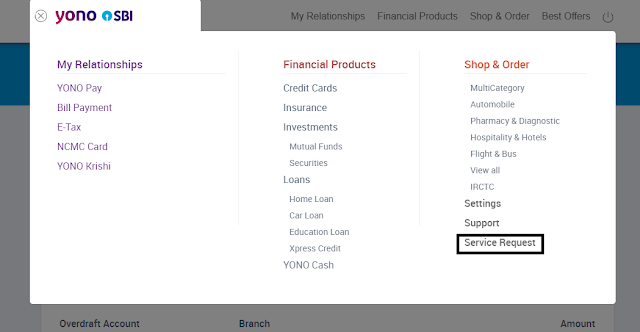

- Log in to SBI YONO

- Go to the main menu and click on to “Service Request” menu.

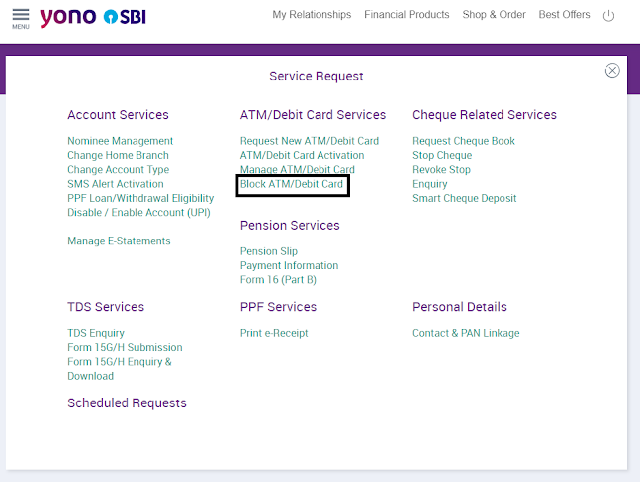

- On the next page, select the “Block ATM/Debit Card” menu under ATM/Debit Card Services.

- Provide your Internet banking profile password.

- Select your account number, and choose the ATM card you want to block.

- You can choose to block it either temporarily or permanently.

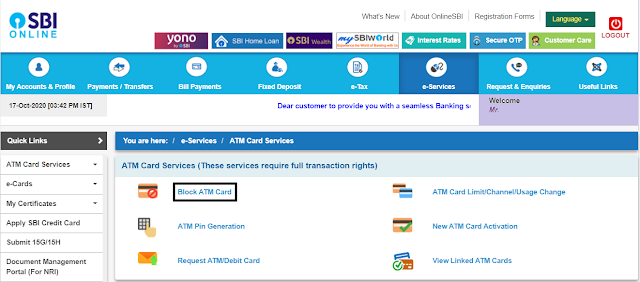

How to Block SBI ATM Cards on SBI internet banking

If you are an existing user of SBI Internet Banking, login to the portal and proceed.

If not, you have to register for SBI Internet Banking. When you have an active ATM card, you can activate the SBI INB instantly with your card details.

Otherwise, you have to visit the bank and activate SBI Netbanking with the submission of the SBI INB activation and registration form.

Once it’s done, follow these steps to block the SBI ATM card instantly.

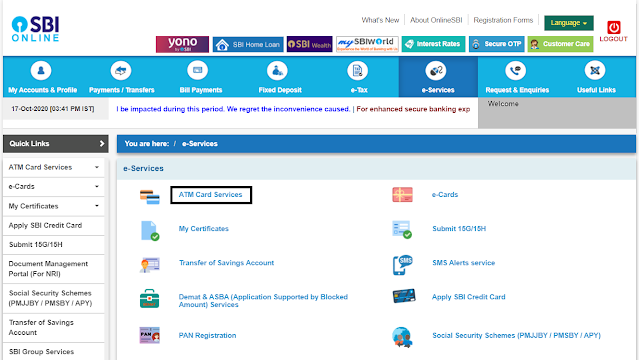

- Log in to the SBI Internet banking site.

- Under the main menu, select e-services.

- On the next screen, you will see the “ATM Card Services” menu. Select and proceed.

- Click on the “Card Blocking” menu on the next screen.

- Select your account number and card number, and confirm.

- Your card will be blocked, and a confirmation message will be sent to your registered mobile number.

3. Blocking SBI ATM cards through tele-calling

The simplest way to block your card is by calling the SBI Customer Care number, which is provided on the back side of the card.

The helpline numbers imprinted on the card are 1800-112-211/1800-425-3800/0091-80-2659-9990. You can call up these numbers and block your card instantly.

They may verify your card number and details of your card, such as the account number linked with the card, registered mobile number, name of the cardholder, and the reason why you want to block the card.

If you provide these details correctly, your card will be blocked successfully, and the confirmation message will be sent to your registered mobile number.

4. Blocking SBI ATM Cards at Branches

Last but not least, if you are not comfortable using all the options given above, you can still visit any nearby SBI branch and request ATM card blocking.

But if you want to block instantly without wasting any time, it’s better to do it on your own. Either by calling the helpline number or through SMS mode.

Blocking through Internet banking is also less time-consuming, provided you have a good internet connection.

Stolen ATM Card: You Don’t Have the Card Number

No need to panic; you can still block your card by telecalling services. The ATM card helpline number is 1800-112-211/1800-425-3800

You can also visit your home branch and get it blocked if you don’t have access to Internet banking. All you have to do is provide your bank account number, or CIF number, to the concerned staff. The process may take a few minutes to get it done successfully.

Conclusion

Overall, it’s quite simple to understand how you can block your SBI ATM card. The process can be done online as well as offline.

Yet, it is a necessity for everyone to know how and when to block ATM cards if any unwanted incident occurs.

Out of the four ways that we have mentioned, telecalling services may be the easiest way to go forward. Sending an SMS to block the card is also satisfying. If you are using YONO and YONO lite, it’s even better.

And the last resort would be to seek the help of bank professionals.

This is a topic that is near to my heart… Thank you! Exactly where are your contact details though?

Good post. I certainly appreciate this site. Keep writing!

Everything is very open with a really clear description of the challenges. It was truly informative. Your website is useful. Many thanks for sharing!

Hello! This is my first visit to your blog! We are a team of volunteers and starting a new initiative in a community in the same niche. Your blog provided us useful information to work on. You have done a wonderful job!

I do agree with all the concepts you’ve offered for your post.They’re really convincing and can definitely work.Still, the posts are too quick for starters. May you please prolong them abit from subsequent time? Thank you for the post.

Hey, thanks for the article.Really looking forward to read more. Really Great.

Thanks for sharing, this is a fantastic article post.Thanks Again. Fantastic.

I wanted to thank you for this wonderful read!! I absolutely lovedevery bit of it. I’ve got you bookmarked tocheck out new stuff you post…

I truly appreciate this blog post. Awesome.

I really enjoy the article.Really looking forward to read more. Cool.

Very descriptive blog, I enjoyed that a lot. Will there be apart 2?

Enjoyed every bit of your post.Much thanks again.

This is a really good tip especially to those new to the blogosphere. Simple but very precise information… Appreciate your sharing this one. A must read article!

Heya i am for the first time here. I came across this board andI find It really useful & it helped me out a lot. I hope to givesomething back and help others like you helped me.

Hello, i believe that i saw you visited my weblog so i came to “return the want”.I’m trying to find things to enhance my web site!I guess its ok to use some of your concepts!!

I really like what you guys are up too. This kind ofclever work and exposure! Keep up the great works guys I’veincorporated you guys to my personal blogroll.

I delight in, result in I discovered exactly what I used to be looking for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

I am really impressed with your writing skills as well as with thelayout on your blog. Is this a paid theme or did you modify it yourself?Anyway keep up the excellent quality writing, it’s rare to see a niceblog like this one these days.

I am so grateful for your article post.Really thank you! Really Great.