SBI mutual funds Investap is a mobile-based application that can be used by investors for easy access to their investment portfolios. It’s one of the most user-friendly types of mobile applications available on Android as well as iOS platforms.

With SBI mutual fund Investap, users can do a whole lot of mutual fund investment transactions. From buying new shares and stocks to the redemption of investments, SBI Investap handles all sorts of transactions you can think of when it comes to mutual funds.

The application is available at Google Play Store and apple store. Whether you are new to SBI mutual funds or you are an existing customer, you can start using the service anytime from anywhere.

What can you do with SBI Mutual Fund Investap

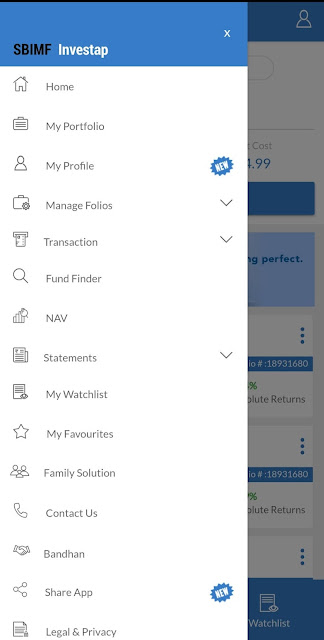

There are a number of things you can do with this app. For example, purchasing a new portfolio, checking your investment details, the redemption of investment, searching for the best fund, real-time NAV of shares etc. All these can be done with a single app called SBI Investap.

Here are the things you can do.

- Management of portfolios, such as linking, unlinking and creating new folios.

- Tracking of the present NAV of the fund.

- You can see which fund is trending and performing well in the market.

- Understand the past transaction of your funds.

- Redemption is at ease, though it takes 4 working days to get it credited to your account.

- You can either invest in a lump-sum amount a go to your selected fund or you can go for SIP (Systematic Investment Plan)

- You can download the statement of investment anytime.

- The customer helpline is effective and resolves issues in no time.

- You can pause your investment at any point in time. Putting a pause on SIP is also quite easy, though you can avail of the facility only one time. A maximum pause period of 12 months can be exercised, it will resume once the period is over.

SBI mutual fund has provided a very easy user-friendly app with which you can literally do everything even without visiting the bank branch or SBI mutual fund office.

Also, read why you need to save money now!

How To Register SBI Mutual Fund Investap

Anyone who is an existing investor in SBI mutual fund or new to SBI mutual fund can use this app.

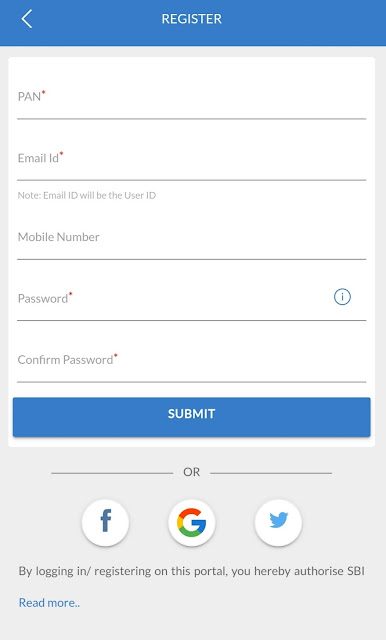

For registration, you must have your PAN card, folio number, email address and mobile number.

When you invest in a mutual fund, always use your official email and your permanent mobile number which is linked to your account.

Note: Your email address will be your user ID.

Steps for Registration of SBI Mutual Fund Investap

Open the app and click on to new user button. Fill up the required data such as PAN number, email address, mobile number, and password and confirm the password.

Once you submit after filling up the data, you will get an OTP (One time password) in your email, which needs to be punched in the next menu.

That’s it! It was too simple right nothing to do.

Your folio number will be auto-fetched by the system and within a few seconds, you will be able to see your investment details.

So, guys, it’s one of the most powerful financial applications available in the market out there. If you are inclined to make some investment for future. Choosing this app would be the right choice.

Last but not least, if you are not comfortable investing a big amount, choose a monthly SIP plan for a small amount such as 1000. It will minimise the risk as well as the financial burden on you.

How To Invest In SBI Mutual Fund Investap

Investing in SBI Mutual Fund Investap is quite easy. The difficult part is the selection of funds and plans that can give you the desired results. One of the best ways to handle the uncertainty of fund selection is to rely on the SBI mutual fund website.

You can find hand-picked funds for first-time investors. Visit sbimf.com and look for a beginner’s kit which is quite an awesome means to get over the problems of fund selection.

Here’s how you can start investing in SBI mutual fund Investap-

- Once you are done registering in SBI Investap, either you can create your folio or if you already have a folio it will be fetched in the application.

- For the creation of a folio, if you have aadhaar card, online KYC can be done otherwise you have to create a folio offline with the bank.

- Select the folio, choose the fund you want to start and proceed accordingly.

- Give the amount of investment and select the date of payment in case of SIP.

- OTM- One-time mandate has to be given in order to complete the investment task. Select the amount of OTM and get it approved with the OTP you received in your email and SMS.

Conclusion

If you are looking to invest in mutual funds, SBI mutual fund is one of the leading investment avenues. With SBI mutual fund investap, your journey of investment is going to be quite easy. You will get an array of options to choose from. Whether it’s a debt fund or equity and hybrid fund, you can have the choice to diversify your investment.

The application is quite easy to use. One of the best apps for Android and iOS platforms. It’s definitely recommended to try it out.