Recently, SBI has come up with a new product of personal loans called YONO Pre-Approved Personal Loans, where no documents are required to be submitted.

It is quite simple and very convenient to apply for customers who require quick funds.

In this article, we are going to share information on the SBI YONO pre-approved personal loan. If you get the offer, then how do you apply? So, without further adieu, let’s begin.

Some facts about SBI YONO Pre-Approved personal loan!

- The facility is not available to all customers of the bank. Only pre-selected customers are eligible to take advantage of it.

- The minimum and maximum amount of loan is ₹ 25000/- to ₹ 100000/-

- The rate of interest is 560 bps above MCLR.

- The loan has to be repaid in 12 months.

- Eligible customers should be between 18 and 58 years of age for CSP accounts and 18 and 68 years of age for non-CSP accounts.

- There is a nominal processing fee, no pre-payment penalty, and no documents need to be submitted to the bank.

The process to apply for an SBI pre-approved personal loan.

You will get an SMS or push notification to the registered mobile number as a congratulatory message.

If you received such a message, then you are eligible, and you can go forward by clicking on the link provided.

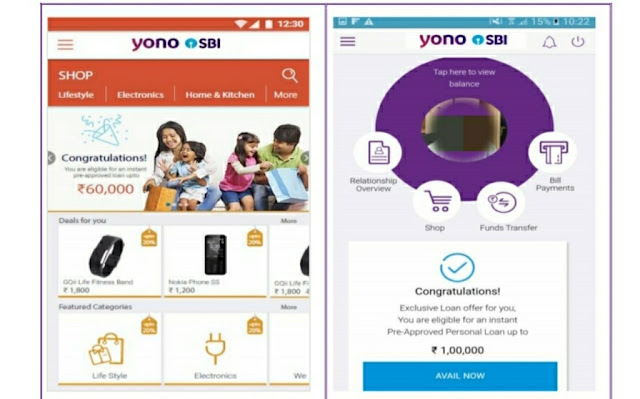

You can also directly go to the SBI YONO application installed on your smartphone and see the offers.

When you open the application, you will see an offer like this:

This is the time when you decide whether to take the benefit or not.

The offer will be there for a month or so. Banks usually send the offer every quarter to eligible customers.

If you have decided to avail yourself of the facility, then what you need to do is discussed below.

Steps To Apply SBI PAPL (Pre-Approved Personal Loan)

Step 1

Log in to your SBI YONO application, or you can go to the official website.

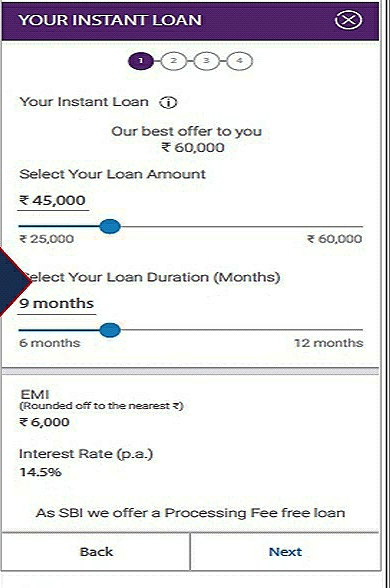

Click on the offer link, and you will be guided to the next menu where the loan amount and loan duration are listed.

You can see the interest rate and EMI. The menu looks like this.

You can change the loan amount as per your requirements, along with the loan duration, but it cannot be beyond 12 months.

In this case, the maximum eligible amount is ₹60000.

Choose your loan amount and loan duration, and click on the Next button.

Step 2

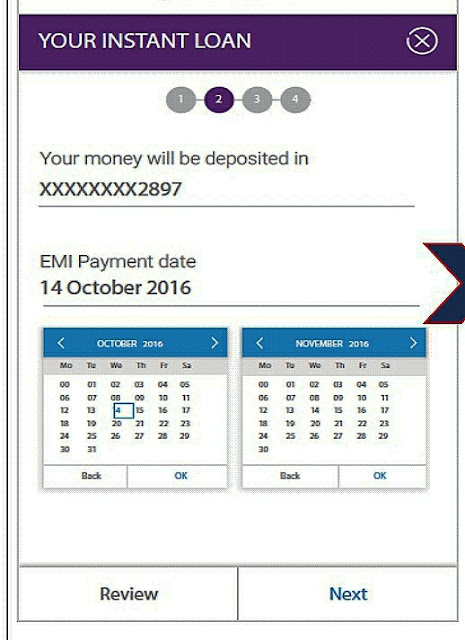

In the second step, you will see your savings account, where the loan disbursement amount will be credited.

You will also get to fix the EMI payment date at your convenience.

Here, you will have the option to review if you want to make any changes, like the loan amount or loan duration.

Once you are satisfied, you can click the next button, which will guide you to the next menu.

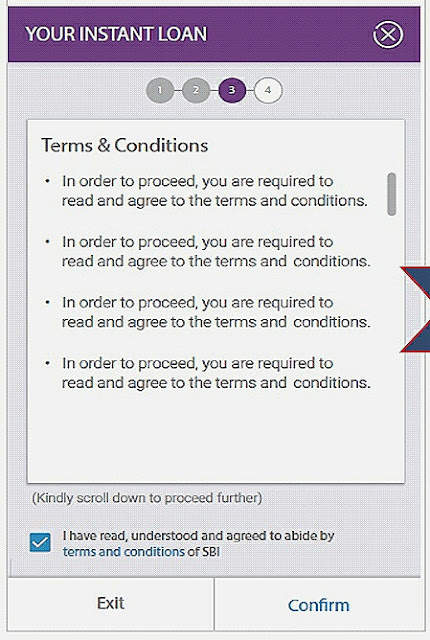

Step 3

It is the terms and conditions page, nothing more. Once you tick the terms and conditions box and confirm,

An OTP will be sent to the registered mobile number linked to your account.

You will have to enter the OTP and finalize your online pre-approved personal loan application.

Step 4

There is no action required for the final step.

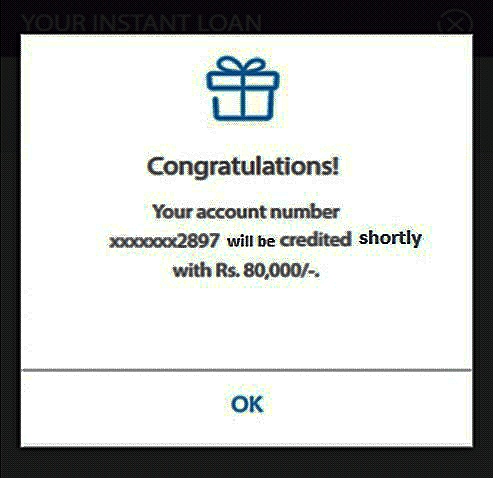

When you authenticate with the OTP you received on your registered mobile number, you will get a congratulatory message showing you the sanctioned amount and the account number to which the amount is credited.

Things you need to follow to get the offer

As we have already suggested, this product is not available to everyone. What should you do to get the benefit of a pre-approved personal loan? Here are some of the tips you need to follow to get the most benefit.

The product is available to the CSP account holder. What is CSP? It is the bank’s Corporate Salary Package Account.

Examples are as follows:

- SGSP (State Government Salary Package Account)

- DSP (Defense Salary Package Account)

- PMSP (Paramilitary Salary Package Account)

- RSP (Railway Salary Package Account), etc.

It is also available to Non-CSP account holders, provided the account has regular credits of salary, pension, rent, etc.

The account should be fully KYC-compliant.

Make sure your PAN is updated in your account.

If a personal loan is availed of, the account should be standard.

The CIBIL score should be above 700 for CSP accounts and 750 and above for non-CSP accounts.

Accounts should be operational for at least one year, and for non-CSP accounts, the account must be operational for a minimum of two years.

For CSP accounts, customers with the last 6 months’ salary credited to the account will be eligible, but for non-CSP accounts, the eligible amount will be as per the Average Quarterly Balance in the SBI account.