Have you ever needed the CIF number of your account and are clueless about where to get it?

Banks use CIF numbers all the time. Every transaction that you do involves CIF, without it, there is no account.

What is a CIF number?

A CIF stands for Customer Information File. It is the first and foremost thing banks create before an account number is generated.

A CIF is an 11-digit number that stores all the personal details of the account holder.

Both personal accounts, as well as non-personal accounts, have a specific CIF number allotted to each customer.

A CIF stores the personal details of the applicant. A few other details are also stored, which are listed below for your information.

- It stores your basic details, such as your name, guardian’s name, date of birth, and permanent and correspondence addresses.

- It also stores your annual income and occupation.

- It captures your ID cards, which you have submitted as proof. Also, PAN details.

What are its uses?

The uses of a CIF number are vast. Banks use this number now and then. Whenever you update KYC, it’s done on your CIF.

When you want to change your addresses or update mobile numbers/emails, it’s the CIF that handles your requirements.

The CIF number is the foundation of your bank account. Its creation is mandatory for opening an account.

Apart from the above, from the customers’ point of view. The uses of a CIF number may include the registration of SBI internet banking.

While resetting the login password for Net banking, the CIF number may require feeding into the system.

Where do you get a CIF number?

It’s easy to find your CIF number. If you do not already know where to get your CIF number, follow the instructions below.

- A CIF number is normally printed on your passbook. It is generally just next to the account number. You will find it on the front page, where your personal details are printed.

- You may also find your CIF number in the statement of account. Get a print of the account statement and refer.

- The CIF number is printed on your chequebook. If you have a chequebook please refer, you may find the 11-digit CIF number.

- Have you received a welcome letter from the bank? If yes, you may refer to that too.

- Have you received an ATM card recently? If yes, see the backside of the instruction note. You may find the CIF over there too.

- Visit any nearby SBI branches and request a CIF number. The concerned staff may ask you for a few details for confirmation.

There are other ways to find the CIF number. Under normal circumstances, when you have a passbook, things are not that tough.

Open the passbook, and there you go. But when you do not have it and visiting the branch is unlikely to happen, then you have left yourself with the following options:

How to find a CIF number when you don’t have a passbook?

When you do not have a passbook or are not accessible to the bank, you may rely on Internet banking to recover your CIF number.

It’s easy, and you can get it instantly. But you have to have active Internet banking with a username and a password.

Here’s how you find your CIF online.

Through internet banking

The process to find CIF on a bank’s Internet banking is very simple. Follow the steps to get your CIF number.

- Go to the bank’s official website and login to SBI internet banking.

- On the landing page, go to the menu and select My Account Details.

- The next page shows all your account details.

- Under transaction accounts, you may see the link for viewing nomination and PAN details.

- Click on that, and you get your CIF number.

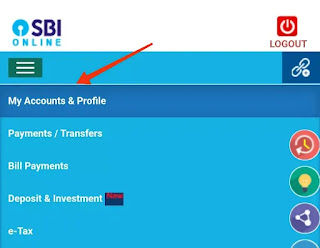

Select the menu My Accounts & Profile.

Click on the link View Nomination and PAN details.

When you click the link, another page with a CIF number will open up.

Through SBI YONO

If you do not have access to SBI YONO yet, you have to register to get access. The process is easy and self-explanatory.

Go to the Google Play Store and download the app. Do the one-time registration process with your Internet banking username and password.

If you do not have Internet banking at all. You may do so directly with the SBI YONO app through the existing customer’s new registration.

You may easily register for SBI YONO in no time.

Now, let us see how we get the CIF through SBI YONO.

You may also get the CIF on SBI YONO. To get it, follow the instructions mentioned below.

- Open the SBI YONO app and login with your username and password.

- On the landing page, select the many My accounts.

- If you have multiple accounts, select any account and download the account statement.

- In the statement of account, you will find the CIF number.

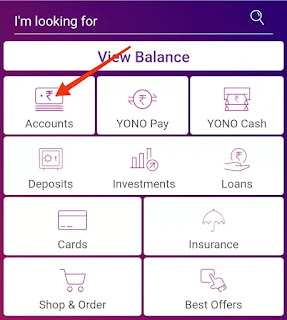

Select the menu Accounts, which is as seen above.

Download the statement of account as depicted above. It is seen as a tiny picture of a passbook and an envelope.

- Click on the passbook picture to download the statement.

- And if you click on the envelope picture, a statement will be sent to your email ID.

The account statement is a password-protected PDF file. The password would be DDMM@XXXX where

- DD stands for date of DOB.

- MM stands for the month of DOB.

- XXXX is the last 4 digits of your registered mobile number.

For example, if your DOB is 01.01.1988 and your registered mobile number is xxxxxx9988, then the password would be 0101@9988

By calling the customer helpline

If all the above-mentioned processes are not feasible for you,. You may have only one option left.

Call the SBI customer care helpline. The customer care helpline is available on the bank’s official website.

You may find the customer helpline number on the backside of your ATM card. There will be 3 customer helpline numbers.

If you do not have an ATM card. Please get the numbers from the bank’s official website, as searching for a helpline number online may be a bad idea.

Please visit onlinesbi.com to find out the contact number.

Once you get the helpline number, you may call them and ask for the CIF number. After due verification, you may get it.

How CIF is related to an account number?

A CIF is specific to each account holder. A person can have only one CIF, though he can have multiple accounts.

You can say that CIF is the backbone or foundation of an account. When banks establish a relationship with a customer, his personal details are captured in CIF only.

After CIF is successfully created, only then an account, which can be a savings bank account, fixed deposits, recurring deposits, loans, PPF account, or any other specific account number, is allotted.

That is why a person can have a savings bank account as well as other deposits and loan-related accounts.

Conclusion

CIF (Customer Information File) can be easily found in several mediums. The reason we do not know about it is because its use by an account holder is very rare.

We use only an account number, as most financial transactions require an account number only.

The need for a CIF has only come up recently with the advent of Internet banking. Moreover, the purpose of CIF is mainly for account maintenance, which is used by the banks only and not by customers.

Though we still require it, knowing about your CIF number is a good thing, as it is yours and only yours.