SBI loans against FD are one of the cheapest types of personal loans you can get. If you have fixed deposits in SBI and need instant funds, SBI loans against FD is one of the best option to go for.

Availing a loan is way too easy nowadays. Yes, it is. And you can apply for these loans online as well as offline. In this post, we are going to throw some light on loans against FD or the overdraft loan account.

There are two types of loans you can get against your FD. Demand loan against your FD which is payable to the bank on demand. You can also set monthly EMI to pay the loan.

The other type of loan is the overdraft loan against the FD account. This overdraft account can be used as a normal bank account where you can perform usual banking transactions.

SBI Loans Against Fixed Deposits

There are two types of personal loans you can get with your fixed deposits. One is a demand loan and the other is an overdraft against FD.

Demand Loans against FD

A demand loan against FD is a security-backed loan with a decent interest rate. Your fixed deposit will be securitised against this loan which can be withdrawn only when you repay the demand loan.

Repayment can be done in EMIs or pay the total outstanding amount at the end of the loan tenure.

To apply for demand loans against FD, there is no online facility. You have to visit the bank to get the benefits.

Overdraft Loans against FD

An overdraft account will be given to you with a certain limit against your FD account. This account is quite flexible in its uses. You can use the account as a normal banking transaction account.

The terms and conditions of both loans are more or less similar. For instance, the rate of interest will be 1 percent above the FD rates. Both are given against the face value of the fixed deposit account you have.

Important Features of SBI Loans against FD

For a demand loan, you have to visit the bank to avail the benefits whereas overdraft against FD is available online as well as offline.

The OD facility is available to a person having TDR, or STDR in his sole name.

The eligible loan amount is 90 per cent of the face value of the FD if it is STDR or eSTDR otherwise it’s 75 per cent of the face value of its TDR or eTDR.

An overdraft account has a lesser limit provision of 75 per cent against the face value. If you have an FD of ₹1 lakhs, you would get ₹90000 as a demand loan or ₹75000 as an overdraft loan.

In order to get the loan facility, the minimum FD amount is ₹5000.

The loan tenor is 3 to 5 years which depends on the tenor of the FD but the minimum it is 3 years.

When you avail of the demand loan, it has to liquidate when the tenure is over whereas, in an overdraft account, you may have the option to extend the limit for many terms provided you keep the FD account intact.

You can also go for closure of the loan account on or before the end of the overdraft tenor. Otherwise, you have the benefit of a limit expiry extension as well.

In the case of TDR if the person is drawing interest payout monthly, quarterly or annually, that interest payout will be diverted to the OD account automatically.

Transaction in the OD account can be done through cheque or INB.

Closure of the OD loan account can be done only by visiting the bank branch.

Features of Personal Loan Against SBI Fixed Deposit

| Types of loan | You can get it as a demand loan or an overdraft loan. |

| Tenure of loan | Usually, it depends on the FD tenure. |

| Interest rate | 1 percent above the Fixed Deposit rate. |

| Eligible amount | 90 percent of the face value of Fixed Deposit. |

| Margin | It is 10 percent but for overdraft, it may go even higher. |

| Processing Fee | Nil |

| Security | The fixed deposit will be secured against the loan. |

| Availability of loan | The loan can be applied both online and offline available to every branch of the bank. |

How To Apply for a Loan Against SBI Fixed Deposit on YONO?

Simple! If you enjoy SBI internet banking or YONO, you can get it instantly in a few steps.

Log in to YONO, and click on the menu. You will find the link for a loan. Click on to that

On the next page, you will see options for overdraft against FD. The screenshot looks like this.

Now, you see the menu for applying an overdraft against FD. Click on that and the system will show you the next screen where your FD account can be seen.

You have to select which FD account you would want to use for applying for the loan.

Once you select it, at the bottom of the page you will see the option to avail overdraft.

When you select the avail overdraft option, the system will guide you to the next screen showing you the eligible amount, tenor and rate of interest.

All you need is to confirm.

Once you confirm the transaction, the system will prompt you stating your account has been successfully opened and confirm that full transaction right has been given to the OD account.

That’s it! Now you can transact your newly created OD account. Usually, the transaction right is given automatically when the account is created. If not, you can seek advice from the bank and get it done.

The loan processing, sanction and disbursal, all happen within a few minutes.

How To Apply for a Loan Against SBI FD on Internet Banking?

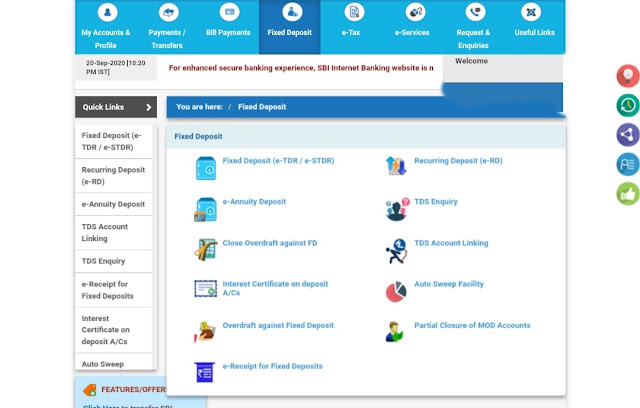

You can also go to the SBI online site, log in to it and apply the same. For easy reference see down below.

Click on Overdraft against fixed deposit, the rest are more or less the same as that of YONO.

If you are not using SBI internet banking or YONO, you can visit your SBI home branch and apply for it.

How to Apply for SBI Loans Against FD at the Branch?

If you prefer to apply by visiting your branch, you may get two choices.

- Demand loan: It’s normally for 3 years and the mode of payment will be on-demand or on or before the end of the third year of the loan tenure.

- Overdraft: As it is mentioned earlier. Its uses are quite flexible in nature.

These are the document that requires applying for SBI loans against FD.

- ₹ 1 revenue stamp.

- Your TDR/STDR advice

- KYC documents

- 2 passport-size photo

Benefits of loan against SBI Fixed Deposit

This type of loan gives immense benefits to the customer because of its secured nature. Not only because of low interest which is 1 percent above the FD rate, but it also gives you the opportunity of keeping your fund intact and paying the loan in EMIs.

When the loan outstanding is fully paid, the bank releases your FD. Here are some of the benefits you can get with a loan against an SBI fixed deposit.

| 1 | Up to 90 percent of the face value of a fixed deposit can be availed under the scheme. |

| 2 | Besides giving you the opportunity of getting quick funds, it reserves your hard-earned money. |

| 3 | The interest rate of the loan account is just 1 percent above your FD, so compared with others, it’s the cheapest interest rate you can get. |

| 4 | Repayment can be done as and when you have excess funds in your account. But it should liquidate before the expiry of your limit. |

| 5 | Don’t have to visit your home branch, which means you can apply at your convenience. |

| 6 | It’s a paperless transaction if you apply online. It’s convenient and hassle-free. |

| 7 | The loan is available as a demand loan as well as an overdraft loan. If you want to enjoy OD limit, you have a choice to do that. |

| 8 | There are no processing fees linked to it. |

| 9 | You can advise your branch to execute the monthly payment toward the loan outstanding. |

| 10 | You can close the loan account anytime before the completion of the loan term. |

Loan against FD is a simple yet powerful financial management tool. Your FD will keep on earning interest till it matures.

At the end of the day, the maximum portion of interest nullifies and you get the benefit of not losing your principal too.