A personal loan is a type of loan that is given against a salary, pension, or fixed deposit. Personal loans against salaries or pensions are normally unsecured kinds of loans that banks lend to their customers based on salaries.

A personal loan against a fixed deposit and other specified securities is a secured loan in which the bank places a lien on the FD or specified securities as collateral security against the loan.

When you repay the loan, the bank will give you back the FD or any collateral you provided while getting the loan.

Now we know that if you are looking for a personal loan, you have to have either a regular source of income in the form of monthly salaries or pensions, or you should have a fixed deposit or other form of investment that can be used as collateral security against the loan.

Here are some of the investments that can give you loans when required:

- PPF: Public Provident Fund

- Fixed Deposits and Recurring Deposits.

- Gold ornaments

- Life insurance policies

- Mutual funds.

- National Savings Certificates

- Shares and debentures.

- Bonds.

Personal loans for salaried people

A person who is getting a salary credited to his account can apply for a personal loan at any nationalized or private bank.

Having a clear idea of what you’re about to embark on before visiting the bank can simplify your decision-making process and improve your understanding of the product.

Whether you go ahead and seal the deal or you decline,. It would help you decide much better.

From identifying and choosing the best one for yourself to better understanding the pros and cons of various products that are available at your disposal, let’s understand better on how you should go forward and apply for a personal loan.

How to apply for a personal loan?

Applying for a personal loan is easy. All you need to do is provide certain financial documents, fill out the application form, submit it to the concerned staff, and wait for the processing of your proposal.

Generally, here’s how you can apply for it:

Visit your bank

The first and foremost thing to do is pay a visit to your bank and try to find out the terms and conditions of a personal loan. For this, you can actually search online too.

You can get the details for each bank on their website. While understanding the product, all you have to ask yourself is: the rate of interest bank is offering, the processing fee, cost of stamp duty, insurance, etc.

Also, get the required formats and application form while you are in the bank. You don’t want to come again for the same.

Arriving at the Quantum of Loan

Well, when you have a pretty good idea of a personal loan, you may have come to know the maximum eligible loan amount you can get against your salary.

The eligible amount is one thing, and how much you take out as a loan is another thing. Its advisable to get as little as possible as a loan. The reason is simple: the more you take out a loan, the more money you are going to pay back.

In short, if you rely on a loan, only borrow what you need. It will save you money and enable you to control your debts in a better way.

Compile your Documents

Once you have decided on the quantum of the loan, you are going to apply. Keep the following documents ready:

| Required Documents | How You Need to Prepare |

|---|---|

| 1. Salary Slips and Bank Statements | The bank usually asks for the last 3 to 6 months of salary slips. |

| 2. Form-16 or Income Tax Returns (ITR) | Latest ITR or Form-16 |

| 3. PAN Card | Xerox copy |

| 4. Office ID Card. | Xerox copy |

| 5. KYC Documents | Aadhaar card, Driver’s licence, Voter card, Passport |

| 6. Non-Judicial Stamp Paper | The value of the stamp depends on your area of jurisdiction |

When you already have these documents ready and your credit score is positive, your loan application will be processed in no time.

Some Tips

- Check your CIBIL score. It should be more than 650. The better the CIBIL score you have, the better deal you get.

- Confirm that there are no bad debt remarks in your CIBIL report.

- Salaries credited to your account are as per the bank’s norm. For the State Bank of India, a person has to have a minimum of ₹15000 as a net salary income. The net salary is the take-home pay that you get in your bank account.

- Net salary equals gross income minus deductions, which are credited to the bank account.

- There should not be a non-credit of salary in your account. If a month is missed, there should be a valid reason for that.

Submit it to the Concerned Staff

Now the hard part is done. Submit all the papers along with the filled-out application form to the concerned staff.

Let them verify your thing. Once your papers have been reviewed, your proposal will be processed quickly.

When all the processes are completed, you will get a sanctioned letter, and the funds will be released to your bank account.

Alternatives

We have been discussing the manual for applying for a personal loan. You have other means of applying it. These may include online banking and mobile banking.

The good part is that with online banking, you can apply for, submit, and process your personal loan on your own.

During the process, the system will verify your income details and arrive at your eligible amount.

Once, you have come to this point, you can complete the transaction, and the sanction and release of funds will be happening shortly.

See if You’re Eligible for Pre-Approved Loans

If you are looking for a personal loan, see if there are any offers available for you. Many banks offer pre-approved personal loans online.

These offers are usually available through the online banking mobile application.

Its worth checking out your online banking platform if you’re going to apply for it.

Also, read our post on SBI PAPL loans.

Things you need to be Aware of

While applying for a personal loan, there are certain basics you need to know before sealing the agreement.

These are mentioned below:

- Prevailing rate of interest.

- The tenor of the loan.

- Prepayment penalties.

- Penalty for EMI failure.

- Is insurance required?

- How much is the processing fee?

- Is there any hidden charge, such as a service tax?

Here is an example of a personal loan. If you are earning a monthly salary of, say, ₹20000. The bank normally gives you 20 to 25 times your net monthly income.

Your eligible amount will be ₹ 480000 if we consider 24 times NMI. You will be eligible for the said amount as long as your EMI/NMI ratio is below 50 percent.

The EMI/NMI ratio is the value that determines your exact eligible amount.

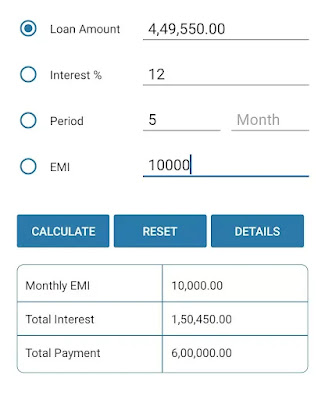

For example, if the rate of interest is 12 percent, for a loan of ₹ 480000, the EMI for 60 months would be ₹ 10677. Your EMI/NMI ratio would be 53 percent. Which is 3 percent above bank lending terms and conditions.

So, the bank would lower your eligible amount to compensate for the EMI/NMI ratio and give you a loan slightly lower than the initial eligible amount.

Also, read our post on how to close a personal loan account.

Some banks fixed the EMI/NMI ratio at 50. Additionally, a few other banks might have a higher EMI/NMI ratio because that is what the concerned bank management decides. It may go beyond even 60 percent.

After the eligible amount has arrived, which is ₹ 449550 at an exact EMI/NMI ratio of 50 percent, how much are you going to get in hand?

Let’s say a processing fee of 1 percent of the sanctioned amount.

Then, an amount of ₹ 4495.5 will be deducted from the sanctioned amount.

That leaves ₹ 445054.5, which you are going to get provided you have not done any insurance on the loan account.

If you do, roughly another ₹ 10000 to ₹ 20000 might get deducted, which further decreases your entire amount up to ₹ 425054.5

How to save the interest that you pay on loans?

Yes, this is the fact that almost all of us do not give it a thought. We often do not care at all, but the interest that you pay has a huge impact on your personal finances.

In the above example, with that loan of ₹ 449550, you are going to pay ₹ 150450 as interest toward the total outstanding in a span of 5 years. It’s not a joke, you know! So, how do we save this amount?

Let’s see what options we have!

SIP (Systematic Investment Plan) is a great choice. In fact, there are a number of funds that can yield attractive returns in 5 years. It can go even ₹150000 mark quite easily.

With the right financial assistance and a little bit of risk, there is a huge potential that you may easily earn and surpass that amount of ₹ 150000 with as little as ₹ 2000 of monthly SIP in mutual funds.

SIPs of SBI, Axis, HDFC, and ICICI mutual funds are worth enrolling in.

Another alternative is when your bank requests loan insurance. Seek out an insurance product that gives you returns along with covering the risk of the sanctioned loan amount. Life insurance is one option on which you can rely.

It will cover your life as well as the loan. For the said loan, to cover ₹450000, you may require a life insurance policy with ₹45000 annual premium.

The term of life insurance may be longer, but it is worthwhile to enroll in it. In the event of your death, the bank will recover the due amount from the insurance company.

Monetary benefits from your department will be left untouched, and your family will lead a better life.

Opening a fixed deposit does not sound good, but you can do it if you have surplus funds. It can generate that amount of ₹150,000, but the investment amount would be high. But, basically, it does not make any sense. If you have the funds, why borrow?

Conclusion

Personal loans are unsecured loans given against a salary, pension, or fixed deposit. They are secured by placing a lien on the FD or specified securities as collateral security. To apply for a personal loan, one must have a regular source of income, such as monthly salaries or pensions, or a fixed deposit or other investment that can be used as collateral security.

Some investments that can provide loans include PPF, fixed deposits, gold ornaments, life insurance policies, mutual funds, national savings certificates, shares and debentures, and bonds. A person can apply for a personal loan at any nationalized or private bank.

To apply for a personal loan, visit your bank and research the terms and conditions of the loan. Determine the maximum eligible loan amount and prepare necessary documents such as salary slips, bank statements, Form-16 or Income Tax Returns (ITR), PAN card, office ID card, KYC documents, and non-judicial stamp paper.

Submit all documents and the application form to the concerned staff, who will review your application and process your proposal. Once all processes are completed, a sanctioned letter will be issued, and funds will be released to your bank account.

Online banking and mobile banking are alternatives to applying for personal loans, as they allow users to apply, submit, and process loans independently. Pre-approved loans are often available through online banking platforms, and it is important to be aware of the prevailing rate of interest, loan tenor, prepayment penalties, EMI failure penalty, insurance requirements, processing fee, and hidden charges.