What is doorstep banking?

Doorstep banking is an initiative taken by the PSB Bank Alliance to serve consumers at their doorstep.

A number of services can be availed of by the end user. Banks provide cash delivery and pick-up services through their representatives.

Other than cash, various non-financial transactions are also delivered. The service provider is Atyati Technologies Pvt. Ltd.

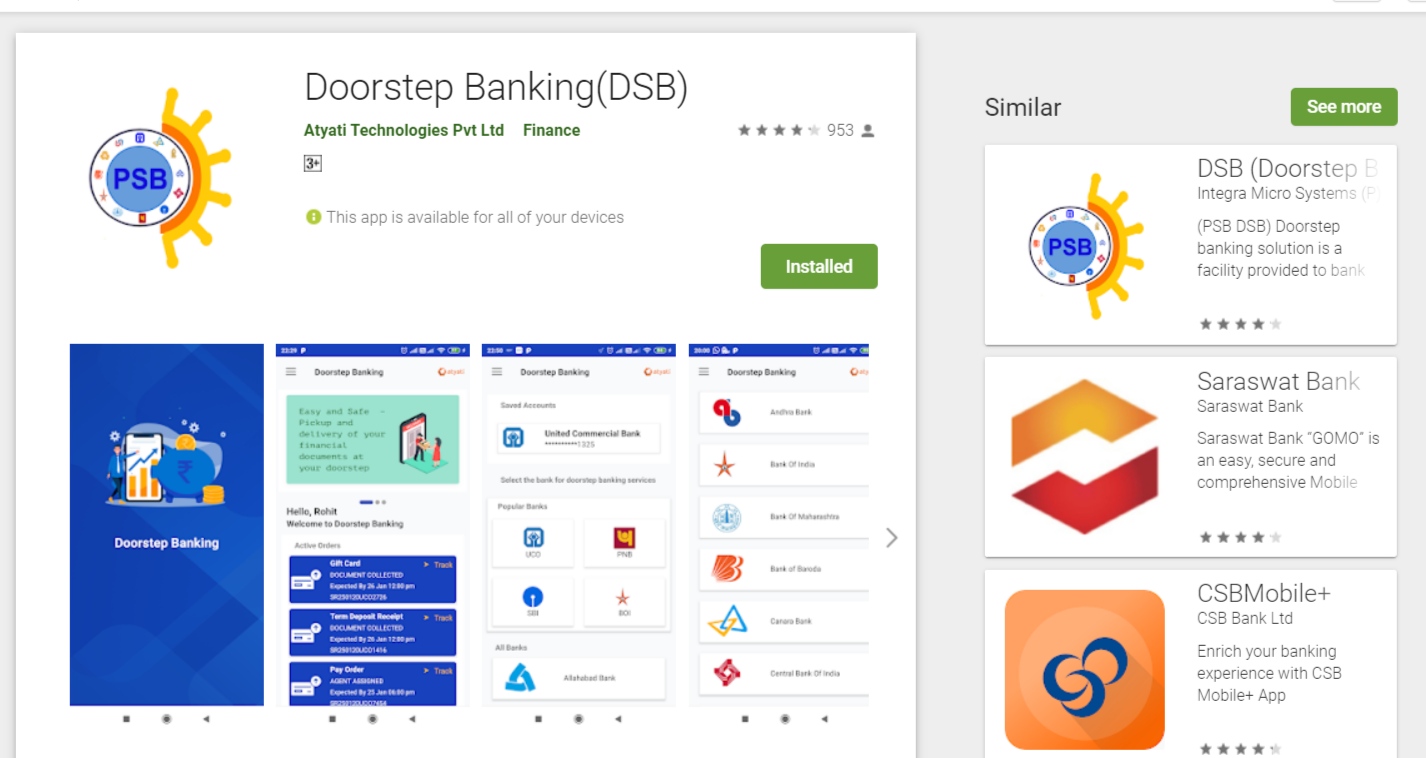

The mobile application can be downloaded from the Google Playstore.

Not all bank branches deliver the service. Only the selected branches deliver the services within a 5 km radius.

Rural areas are yet to be penetrated by the service. At present, Doorstep Banking agents are deployed in 100 major centres all over the country.

Who is eligible for Doorstep Banking?

According to the official website, the service is meant for senior citizens and people with disabilities. But as of now, we have seen that all account holders can use the facility.

Except for minor accounts, joint accounts, and non-personal accounts, where this facility is not extended.

The joint account holder can benefit from the service if the mode of operation of the account is ‘ Either or Survivor’ or ‘Former or Survivor’.

How to register for Doorstep Banking Service?

The service provider is Atyati Technologies Private Limited. Their application, ATYATI can be downloaded from the Google playstore.

Registration is very simple. The process involves the creation of a 4-digit PIN. Here’s how you sign up for Doorstep Banking:

| Step 1 | Download the ATYATI application from an app store, such as the Google Play Store. Install and open it. |

| Step 2 | Click the sign-up button and carry forward. |

| Step 3 | Provide your bank-registered mobile number, create the 4-digit PIN, and complete the task. |

| Step 4 | Now login again with the PIN and link your bank account by selecting your bank. The system will ask you for the last 6-digit of your bank account. Provide it and complete the task. |

| Step 5 | Once you have completed these steps, you are ready to use the doorstep banking service at your convenience. |

Service Charges of Doorstep Banking

The bank charges a nominal fee for delivering the services.

For non-financial transactions such as the delivery of the statement of account, TDR receipt, Form 16, Form 15 H/G, demand draft, and cheque request the fee is ₹60 plus GST.

For financial transactions, it’s ₹88 plus GST.

Service Request for Doorstep Banking

There are a range of services it can deliver to you. You can enjoy both financial and non-financial services. These services can be understood by considering the following points. Read on.

Pick-up requests Where bank representatives visit you to pick up your request. These are

| 1 | Demand draft purchase |

| 2 | Pay order |

| 3 | Standing instructions on your internal accounts |

| 4 | Cheque book request |

| 5 | Doorstep Banking Life Certificate submission |

Delivery request Where bank representatives visit you to fulfil your request.

| 1 | Delivery of term deposit receipt |

| 2 | Delivery of TDS/Form 16 |

| 3 | Delivery of your pay order, demand draft |

| 4 | Delivery of the account statement and Gift card you request. |

Cash transactions Services of card-based and AEPS (Aadhaar Enabled Payment System) cash withdrawals

Additional services Under this, you will find services for pensioners’ life certificates.

A few points to remember

| 1 | The service is available from 9 a.m. to 4 p.m. |

| 2 | Withdrawals have to be done either through an ATM card or through AEPS |

| 3 | The maximum amount that can be withdrawn is ₹20,000 per transaction per day. |

| 4 | There is a service charge ranging from ₹60 to ₹100 plus GST. |

| 5 | All the public-sector banks are undertaking the DSB alliance. |

| 6 | You can cancel the service if the need arises. The cancellation charge will not be there if you cancel before the agent picks up the documents from you or the bank user completes the request. Otherwise, a service charge will not be refunded. |

| 7 | You can make complaints about disputed transactions on the app. A dispute ID will be assigned to you, and your case will be solved accordingly. |

Worried about the Identity of the DSB agent

Do not worry. You will already have the details of the person who is going to come visit you. The credentials of the DSB representative, along with the photo, will be on the mobile application. Besides, you will get an SMS as well. The representative will wear the uniform dress code of DSB and the service provider Logo.

If required, you can ask for identification to verify the representative.

So, is doorstep banking safe? What we think is that the service is reliable, as the representatives staff are bank appointed only.

Moreover, you can always rely on non-financial services to stay confident in dealing with the services you are getting.

Doorstep Banking SBI and the Popular Banks

The above-mentioned services can be availed of by banking service consumers. If you have a bank account with one of the following banks, then you might be able to use the service, provided your bank serves doorstep banking in your area.

| Sl No | Banks that serve Doorstep Banking |

| 1 | State Bank of India |

| 2 | Bank of India |

| 3 | Bank of Baroda |

| 4 | Bank of Maharashtra |

| 5 | Canara Bank |

| 6 | Central Bank of India |

| 7 | Punjab National Bank |

| 8 | Indian Overseas Bank |

| 9 | UCO Bank |

| 10 | Punjab & Sind Bank and Union Bank |

Conclusion

The DSB service is a revolution in the banking sector. While its uses are not as popular as expected. Considering the type of end user, this service is useful to those who are sedentary.

You might say that senior citizens are not frequent visitors to the bank for many reasons. These categories of consumers can get home services in a much better way.

It also provides good services to those who have busy work schedules. Doorstep banking is a kind of service that provides additional services to the customer for a nominal fee. When in need, it could give you a better alternative.

You have a genuine capacity to compose a substance that is useful for us. You have shared an amazing post about kids banking Much obliged to you for your endeavors in sharing such information with us.

I couldn’t resist commenting