How can I get a new passbook in SBI? This is what I need and I would love to get it at the earliest. Says Mr George, a senior retiree. But what he went through was completely a series of unfortunate events.

Mr George misplaced his passbook when shifting his residence. He left it somewhere at home but could not remember where he kept it. So he approached his bank to get a new one.

Now the bank is asking for ID verification and other papers which Mr George is quite unable to understand.

At the end of the day, he got his brand new duplicate account passbook but it was time-consuming. He had to spend the whole day getting his new passbook.

If you are in the same situation and you are looking to get a duplicate passbook, here’s what you need to know about how to get a new passbook in SBI.

To get a new passbook in SBI, there are certain procedures one has to go through. Let’s see what are these requirements.

Normally applying for a new passbook is an easy task. Visit the bank and request the concerned staff about the requirement for a new passbook.

The bank staff would ask you for a few details like your account number and previously issued passbook.

You give it and get a new one, that’s all. But, asking for a duplicate passbook needs additional documents such as your KYC documents and an application stating the reason for applying duplicate passbook.

What is a passbook?

An account passbook is a pocket-size booklet for the maintenance of a bank account. Normally it is given to a savings bank account. A current account does not have an account passbook.

The use of an account passbook is quite simple. Whatever transactions you have in the account will be reflected there. Either you visit the bank to get it printed or you may do it at bank outlets which is just the same as an ATM.

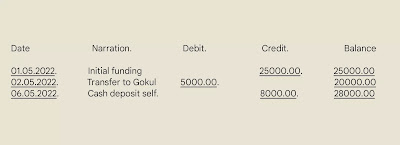

The transactions entries on the passbook look like this

You can track your transaction from the passbook. As you can see details such as the date of transaction, narrations, whether debit or credit and the running balance.

The account passbook simplifies your understanding of every financial transaction that you do. It keeps a record for future reference too.

How can I get a new SBI passbook?

Getting a new passbook is a very simple task. When we open a savings bank account in the bank, we get it along with other papers related to the account.

Although the chequebook and ATM deliver later on, the passbook is normally given on the same day. It becomes complicated under the following circumstances.

How to Get an Inoperative Account Passbook in SBI

An account becomes inoperative when you do not operate it for a long time.

Banks normally classify an account as inoperative when the owner does not use it for 2 years continuously.

Not having a passbook of an inoperative account may give you a hard time getting a new one.

Banks will provide you with a duplicate passbook which requires due diligence of identifying the true account owner.

Submit all papers related to the account along with a valid ID card that can prove both identification and address.

Let the bank do the verification process and wait for it. It may take a while to get a new one.

How to Get Lost Passbook a Duplicate One

If you have lost the account passbook, you need to contact the branch to get the duplicate passbook.

There is confusion on whether an FIR is required to be lodged or not. The fact is, it is not. You may get it with an application requesting a new one.

Bank may insist you for a few documents that you need to produce.

Here are the documents for getting a new passbook.

- A written application.

- KYC documents (You may produce OVD-Officially Valid Documents which include ID as per RBI guidelines, it may be your aadhaar card, voter card, driver’s licence, passport etc)

Stolen Passbook and Applying for a New One

The process to get a duplicate passbook of a stolen passbook is the same as a lost passbook.

You need to contact your bank and follow the same process.

Can I get a passbook from SBI non-home branch?

Although you can print the passbook wherever you are. A new passbook cannot be issued other than at your home branch. For passbook updates, you can either use the kiosk banking where the passbook printing device Swayam is installed or you can visit any nearby SBI branch to do the task.

Do I need to pay?

Most banks usually charge for issuing a duplicate passbook. It may be in the range of ₹ 100 to ₹ 200 but not more than that.

A continuation passbook and a fresh passbook will not cost you a penny.

Duplicate passbook???

It is issued when you have lost the original passbook. It may be a stolen passbook too.

When one is unable to find a passbook then the bank issue a duplicate. Others are issued as a continuation passbook.

How to update a passbook?

To update a passbook, either you can visit the bank and do it over the counter or visit bank outlets to do it on your own.

A passbook needs to have a barcode to update the passbook printing device installed at Kiosk banking. SBI calls it Swayam machine that handles customers’ passbook update offsite away from the branch.

This barcode can be affixed over the counter. At present, the bank issue a pre-barcoded passbook in which an account is mapped and activated while issuing to the customer.

If you update the passbook on the kiosk machine, the process is quite simple. Insert your passbook into the slot and wait for the machine to read the barcode.

The process is self-explanatory, just follow the voice instruction of the machine and you will be able to do it in a minute.

Online passbook, is it for real?

Yes, an online passbook is what people normally ask for. But how? An online passbook is a digital form of a passbook. It is just the same as a normal passbook that we have.

The only difference is all the data are saved in a digital mode. You can see the mPassbook of SBI. It’s available under SBI YONO.

Do I need to rely on an account passbook?

See, a passbook is like keeping a record of what you have done with the bank account.

It can be getting money from someone, paying money to someone and other financial give and take such as bill payments.

So, the requirement of a passbook is a necessity. The question is whether keeping a passbook is better. Or is it something else?

You may rely on online banking which is available 24/7 throughout the year.

You may also rely on a statement of account too.

It’s seen that the latter 2 are more beneficial than owning a passbook. These reasons are mentioned below.

Is there any shortcoming in not having a passbook?

Not exactly a shortcoming but a few disadvantages are there.

- Maintenance of an account passbook is time-consuming. You have to regularly visit the bank to get it printed.

- The problem of loss and stolen passbooks is there. So it is a troublesome kind of thing.

- Sometimes misprinting is due to technical faults. It leads to improper account keeping which arises confusion about past transactions.

Account statement or passbook, which is better?

An account statement that is available online is far better than having a passbook.

Here are the reasons why

- You can download the account statement anytime you wish whereas the passbook is not.

- An account statement is more precise than a passbook as it’s error-free.

- You can do cloud archival of your account statement but you cannot do much with the passbook.

- The statement can be kept in digital mode but a passbook cannot.

- A passbook leads to complications such as issuing duplicate passbooks but online statements of account are not.

- You can keep thousands of transactions archived on your desktop but this thing is not possible with a passbook.

- So, a passbook is limited whereas online banking is unlimited.

Conclusion

It’s quite a common thing to apply for a fresh passbook in the bank. Sometimes, we keep our financial papers in places where we think it’s totally secure. And what happened is that later on we have a hard time remembering which place is that. Don’t you agree?

So, in case, if you happen to face the same issue, you can apply for a duplicate SBI passbook in no time. All you need is to write an application to the bank mentioning the reason for applying duplicate passbook.

Submit the application along with your KYC documents. After due verification by the concerned staff, your brand new passbook will be handed over to you.

However, things might get complicated if your account in non-operational for a long period of time. In such a case, first, you have to update your KYC with proper verification, activate your account with a few transactions and later on you get the new passbook.

Keeping an account passbook is a good thing but one must not rely on it. It is better to rely on digital mode as it would give you better control and an error-free financial record.