Those who have faced the issues might as well know what we are talking about. It’s kind of absurd, you know? Not getting an SMS or OTP when you do transactions in your SBI savings or current account.

Some of us might get an SMS alert only for withdrawal transactions. Some might get it only on deposits. And many of us do not get the SMS alert at all.

Things get worse when we do not get the OTP (One-time password) that the bank used to respond via SMS for various types of authentication.

It may be for Internet banking registration or for a specific transaction, such as an online purchase, where an OTP is required to complete the transaction.

Click here for Troubleshooting YONO sb001 error

Sometimes an OTP or SMS goes to the previous mobile number, even if you have registered a new mobile number in your SBI account.

How do we avoid all of this unwanted stuff? It happens to many of us, and we keep wondering how to address the issue.

Let’s find out why it happened in the first place. And let’s see what we can do to avoid this nightmare once and for all.

OTP (One-time Password)

Ever since the banking system has shifted more towards digital banking, a number of positive outcomes have been observed in many ways. At the same time, we can not deny that some flaws came along with its pros as well.

OTP is a one-time password required for authentication of any sort of transactions done on digital platforms. In banking, OTP is required for authentication of various transactions you initiate. It may be through your ATM card, credit card or internet banking.

OTP acts as a second layer of security when performing personal banking transaction. Without providing them your transactions would not go through.

An OTP, or one-time password, is such an important security tool for various kinds of transactions that its absence would lead to an incomplete transaction.

It may be for a simple fund transfer or it may be for online purchase of grocery items and others, including online bill payment, etc. Without it, you would not be able to complete a transaction.

When you have SBI Internet Banking Facility

If you are an SBI YONO user and you are not getting an OTP, Here’s what you need to check out.

| 1 | Did you recently update your KYC? |

| 2 | Did you mention the new mobile number in the KYC form? |

| 3 | If yes, did you submit a mobile number update request to your bank? |

| 4 | Did you initiate a mobile number change request through the Internet banking platform? |

| 5 | If not, inform the bank official about your inability to use the YONO service. |

The questions above need to be answered precisely to know what went wrong with your account.

If you have not done or initiated any such thing, your account is perfectly fine. Just inform the bank, and your problem will go away soon.

If you want to update KYC on your bank account. Say if your correspondence address needs to be updated. Make sure you request a change of address and provide the registered mobile number (RMN) only.

For internet banking users. Make sure you have initiated it through SBI Internet Banking; otherwise, the process will be incomplete.

How to Change Mobile Number with SBI Internet Banking?

Changing your mobile number through SBI net banking is quite easy.

The process can be done only through the SBI Internet banking web portal.

Both YONO and YONO lite do not have the option for a mobile number change.

Follow these Steps to Change your Mobile Number

| 1 | Go to the State Bank of India’s official website onlinesbi.com. |

| 2 | Login using your INB ID and password. The ID and password you use to login INB, YONO and YONO lite are the same. Don’t get confused! |

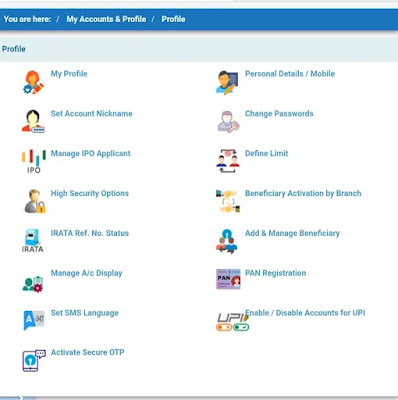

| 3 | Go to my profile section. |

| 4 | There you will see in the top right corner Personal details/mobile number. Click on that. |

| 5 | Put your new mobile number and confirm. You will receive a reference number. |

| 6 | Go to your Bank and get it approved by submitting the reference number to the concerned staff. |

Your mobile number will be activated and SMS/OTP will start delivering to the new number.

You’ve Changed the Mobile Number but OTP Goes to the Previous Number!

This one too is a problem. See, you have updated your mobile number in the account but not been done properly. It normally occurs in Internet banking users. The reason behind this is quite easy to understand.

As we have mentioned earlier, if you are using net banking, you definitely need to initiate a mobile number changing request through the bank’s internet banking platform your request will not get completed although it’s updated in your account.

Submitting your request manually will lead to this issue which will be solved only with Bank intervention.

If such is the issue go to your SBI branch and let them run an account update in their branch net banking platform which would trigger the synchronisation of account details with the Internet banking server and your issue will go away.

Latest Update on the Mobile Number Change Request

If you have the previous mobile number with you, it’s easy and can be done with OTP. While processing you will get an OTP to your previous mobile number which will authenticate to get it changed to a new one.

If you do not have the previous number. As soon as your Bank processes your request, you will get a confirmation message where you need to confirm and respond by typing only YES.

Online initiation of mobile number update will generate a reference number which is required to be submitted to your branch for approval.

This actually answered my downside, thanks!