Payment by cheque is the most common way to fund transfers. With it, you can pay funds to anyone, and you can also encash money from the bank.

Sometimes, we commit mistakes. And if we drew a cheque wrongly and it was already delivered, can you hold or stop the payment of that instrument?

That’s what we’re going to find out. Read on; let’s see what we can do if that’s the case.

But, before we jump into it, let’s understand a little bit about a chequebook and its basics.

What is a cheque?

It is a negotiable instrument that is used for fund transfers between one person and another. It can be issued to a person or an entity for payment of a certain amount.

It can be an order cheque or a bearer cheque. Either way, it can be drawn for payment.

The difference between them is that an order cheque is transferred by endorsement, whereas a bearer cheque is an instrument in which the owner is the bearer of the instrument.

The endorsement on a bearer cheque does not mean much. That’s why an order cheque is considered safer than a bearer cheque.

Who can use a Chequebook?

Anyone who has a savings bank account or current account can use the cheque facility. It includes minors, too.

Illiterate people cannot use a chequebook. They have to rely on the bank to withdraw cash via withdrawal slip with an account passbook.

Banks offer accounts with and without cheque facilities. When you have a savings bank account and you don’t have a chequebook, make sure your bank account has the facility.

If not, you can convert the bank account from a non-cheque to a cheque facility account with a simple application.

How to Draw a Cheque?

It’s one of the easiest ways to pay someone. Drawing a cheque is as simple as filling out your personal details.

The only thing that matters is that no error is allowed when writing a cheque. For each detail that you put in, make sure it’s error-free to avoid payment rejection.

On the front side of the leaf, you would find details to be filled in, such as

- Payee’s name

- Amount in word

- Amount in figure

- Date

- Space for your signature

Fill it up and give it to the person whose name is written as the payee’s name. You can cross the cheque if you want. It will specify the payment instructions.

Either a general crossing or a special crossing, you may add it when drawing a cheque with parallel lines, preferably on the top left corner of the instrument. However, you may add these lines in the middle of it too.

Without any crossing, if you hand it over to another party, he/she can withdraw cash over the counter at bank.

You can add a crossing of cheques to specify how the payment would take place.

A parallel line on the extreme top left corner without any words in it especially means account payee. You may or may not add the word account payee between the lines to be more specific.

If you do that, the payee has to encash it through the account payee only. If he does not have an account, he cannot get the funds.

How to Apply for a Chequebook?

Applying for a new chequebook can be done quite easily. In all the banks, you may choose to apply online as well as offline.

Offline chequebooks can be applied from the bank only.For that, you have to visit the bank and fill out the application form available over the counter.

Sign in and hand it over to the concerned staff. It may take a few days to get it delivered to your registered address.

If you cannot go to the bank, you may put in a chequebook request online. You have to have active Internet banking to do so.

How do you apply SBI chequebook online?

To apply SBI chequebook online, you have to login to the bank’s Internet banking and go through the following steps:

- Go to SBI internet banking official website and login with your username and password.

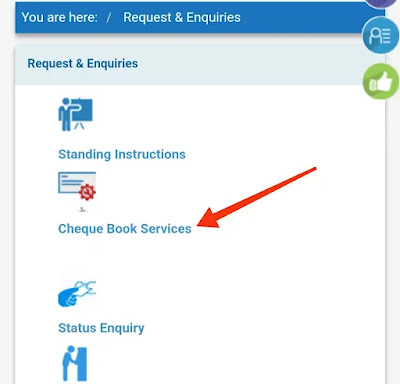

- Go to the menu Request & Enquiries.

- Select chequebook services.

- On the next page, select the account number, and the number of cheques leaves, verify the address, and submit the request.

Login to SBI Internet Banking and select the menu Request & Enquiries.

Select Chequebook Services and proceed.

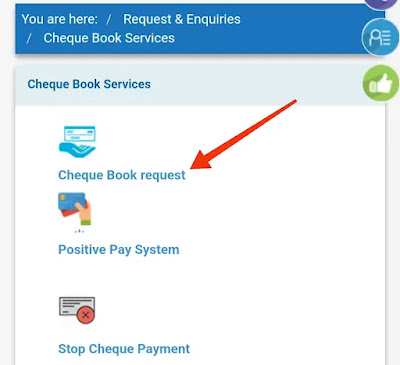

Go for the Chequebook request.

How to Apply Chequebook on SBI YONO?

You can also use SBI YONO to request a fresh chequebook. Follow the steps mentioned below to request a new cheque.

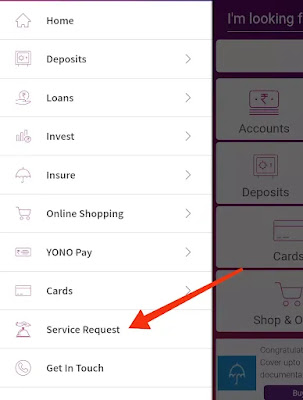

- Open the SBI YONO app and login with your username and password.

- Go to the menu and select Request & Enquiries.

- On the next screen, you will find the options for chequebook requests.

- Click on that and proceed further to complete the process.

Select the menu Service Request.

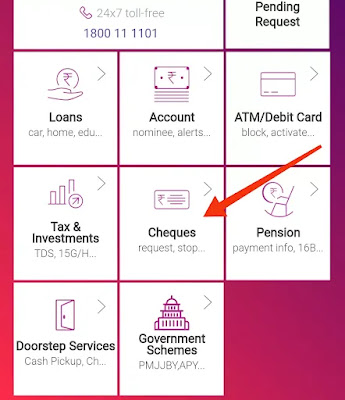

Go to the cheque button.

Select the option Request Chequebook and proceed further to complete the process.

Benefits of using a cheque

One may get a dozen benefits from a chequebook.

Though we know a cheque is used for cash withdrawal, below is the list of benefits of a chequebook.

- It secures your financial transactions. It consolidates and protects your account from misuse

- It enables you to send money anywhere in the world.

- Cancelled cheques are used for confirmation of your account number, bank, and branch, along with the IFCS code and MICR code.

- It can also be used for future debt payments. It can be postdated.

- Ownership of the instrument can be transferred by endorsing and transferring it.

- A cheque can be endorsed multiple times.

Can you Stop the Payment of an Issued Cheque?

The most common issues of using a cheque facility account. Can you stop or hold payment of the instrument that has already been issued?

At certain times, it happens to all of us. When we issue a cheque to someone and later want to cancel the payment of it.

The reasons may be many; some are out of genuine cases, others are somehow misusing the instruments.

But, can you put a hold on payment of the issued cheque? The answer is no; you cannot.

As per NI Act 1988, once the physical transfer of the cheque happens, you may not be able to cancel the cheque payment.

If you do this without the consent of the cheque owner, it would be a criminal offence. If you want to make a stop on payment of an issued cheque, you can do so with the approval and consent of the cheque owner.

If the actual physical transfer of a cheque occurs, there is no way you can cancel payment unless both parties agree upon it.

Cases Where You Can Cancel Cheque Payment

However, there are instances when you can cancel payment of an issued cheques.

These will be purely based on the situation you are in. The bank may or may not accept your request.

Cheque Lost in Transit

When you are not sure of the status of the cheque or if it’s lost in transit, you may contact your bank and request to put a stop payment on that particular cheque.

Your bank may provide you the cheque number if you don’t have it. But, the stop cheque request may cost you a few bucks.

When Both Parties Agree

When you have obtained the consent of the beneficiary and he agrees on it, you may request that your bank cancel the payment of such an instrument.

Here, the bank may ask you for a consent letter from the beneficiary.