If you are looking to open an SBI tax saving FD scheme, here’s what you need to do. This page will let you understand how SBI tax saver FD works. Although, we all know that it can be done by visiting the SBI home branch. We can also open these FD accounts online too.

Like any other form of Fixed Deposit account, SBI Tax Savings FDs are also the kind of fixed deposit that has minimum investment tenure of 5 years. Yes, it’s the only feature that differs from the other FD types.

SBI Tax Savings Fixed Deposits

You may want to know about the terms of SBI tax saver FD which is pretty simple to understand. You just open an FD in your name and the amount invested is exempted from the tax or you could even declare the income tax department when filling up the IDF- Income Tax Declaration form.

Here’s the catch of SBI Tax Savings FD- You cannot withdraw the fund until it matures. The minimum period of investment is 5 years. So, basically, your fund will be kept intact for 5 years. No partial withdrawal facility is available. The FD will be closed on the maturity date. Yes, it will get rolled over if you have mandated the bank for an auto-rollover facility.

You can save as small as ₹1000 and the maximum amount of investment is ₹1.5 lakhs per financial year. But, usually, since the invested amount will be locked for 5 years, people make FD amount of what tax exemption amount he needs.

Interest rates will be as per the bank term deposit rates which keep on changing from time to time. At present, the SBI tax saver has 7 per cent per annum. The period of investment is 5 years to 10 years.

And the most important thing is that the tax exemption will be applicable for the current investment year only. If you want to cover tax exemption for the next year, you have to open another FD during the financial year again. These FDs can be used for exemption of income tax under section 80CC of the Income Tax of India, act.

Let us see the documents that we need to provide in order to have the FD account.

Save tax in the simplest form, you may have other alternatives too, such as life policies, health policies. But, with SBI tax saver FD, the fund management is quite simple. Its very simple, make SBI tax saving FD account whenever you need tax exemption. Though, PPF account and Sukanya Samridhi Accounts are also one of the best tax saving schemes out there.

Opening SBI Tax Saver Account When You Already Have Bank Account

If you have an SBI savings account and your account is KYC compliant, then you need not produce any documents. Just fill up the application form, and provide all your details such as savings account number, PAN number, nomination details etc.

Your SBI tax saving FD account will be opened instantly by the dealing staff. You will be given the printout of the FD advice on the same.

An FD advice is a printout instrument in which your FD details such as amount, maturity value, rate of interest and maturity date are mentioned. Apart from that, the scheme name is prominently displayed as Tax Saving Scheme which makes it easier when declaring income tax through other agencies such as chartered accountant or any other.

When you are an existing customer having a bank account with an online facility, you can also open these accounts online on the bank’s Internet banking website. SBI YONO is another mobile banking that allows you to do the same. The process is simple, read on, you may find the process of doing it below.

When You Don’t Have The Banking Relationship

If you do not have an SBI savings account, then you will have to provide all KYC documents such as your valid ID card where your address is mentioned properly and your PAN card.

Although the bank will insist you to open a savings bank account prior to the opening of an FD account as it would be convenient while depositing to an FD account and closure of an FD too will be at ease if you have an existing account. But it is not mandatory to have a savings account in order to get an FD account.

It is recommended to have a saving account as it would smoothen the process and it would be easier for you at the time of withdrawal or closure of your FD.

Usually, below are the documents that you need to produce to open a bank account including an FD account.

- An application form- You have to obtain it over the counter or download it from SBI Official Website.

- A valid identity card- ID can be aadhaar card, voter card, driver’s licence, or passport. Your name, DOB and address must be proper.

- PAN card- It’s okay if you don’t have a PAN in your name. If that’s the case, you have to provide form-60 else insert your PAN card when applying for the account opening. But for the SBI tax saver scheme PAN is a must.

Please go through the RBI site for more details on KYC documents.

SBI Tax Saving FD or SBI Tax Saver FD can be opned by an Indian individual who has the income tax Permanent Account Number-PAN card. Karta of the HUF-Hindu Undivided Family can open these FD in favour of the HUF. Other than this, SBI Tax Saving FD can also be given to joint names. Either between two adults or an adult and a child.

How To Open SBI Tax Saving FD on SBI YONO

YONO is bundled with lots of facilities that you can be used for financial matters. The country’s largest bank SBI has done quite a remarkable job by upgrading the mobile version of Internet banking to SBI YONO.

One can do any kind of transaction starting from the opening of a savings bank account to various kinds of financial and non-financial transactions.

In the account opening section under FD creation, there is a menu for the creation of fixed deposits for the tax saving scheme. The process is quite simple and easy to understand and moreover, the application is user-friendly.

Now, let us see how it is done with SBI YONO..

The Process Takes 4 Easy Steps

When you login to your SBI YONO, you will see the deposits menu. Go to it and under my deposits menu, you will find the option to open an FD account. Just click on it and proceed.

Step 1. When you click on Open FD account, you will be asked to put the amount you want to open and select the account from which your FD account will be credited.

Note: You will have to tick the button below which is mentioned if you want your FD to be a tax-saver fixed deposit.

When you click on the next button, the system will prompt you about the details of the SBI tax saving scheme. Click okay and proceed.

Step 2. In this step, you will have to choose the tenor of FD. The minimum is 5 years as the lock-in period of the tax saving scheme is 5 years.

Provide the tenor of FD at your convenience. At this moment, down below the screen, you will be able to see the rate of interest the bank is offering you.

Click on the Next button and proceed.

Step 3. Here you will be given the option to choose for interest payout. You will be given 4 options on how you would want to get your interest in your savings account. These interest pay-out options are-

- Monthly

- Quarterly

- Half-yearly

- At maturity.

As per your requirement choose anyone and proceed to the next step.

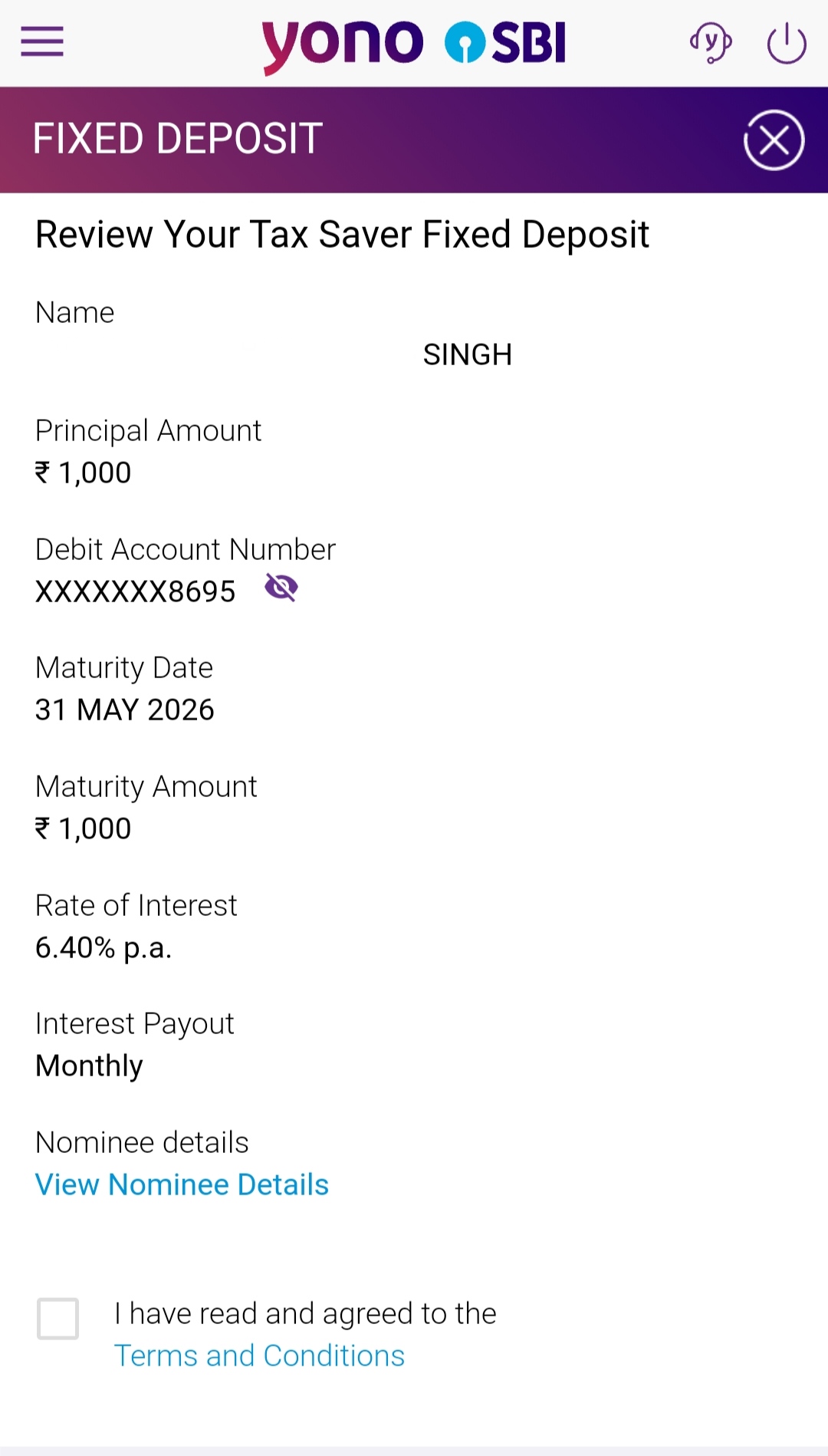

Step 4. This step is only for confirmation, nothing else. It is just a review page where your FD details will be displayed. Check whether all the details provided are okay or not.

Check if the FD amount and interest payout method are fine or not. Click on the next button and your FD tax-saving scheme will be open.

Your FD details will be given on the next page along with the congratulatory pop up which says you have successfully created your tax saver fixed deposit with the FD account number.

This is how it looks when you are in the last page.

Visiting SBI Branch to Open SBI Tax Saver FD

If online banking is not convenient to do the task and frankly if you don’t want to take the risk of a clerical error. You may visit any nearby SBI branch to open an SBI tax-saving FD in your name.

To do this, you will need the following documents-

- An application form

- Valid ID card

- PAN card

- Passport-sized photo.

Fill up the application form, and provide all your details on it. It could be your savings bank account number, mobile number, date of birth, PAN number, nomination details etc. Fill up all the details and put your signatures wherever it needs to be.

Submit the application to the concerned staff. With due verification, your SBI tax saver account will be open and the printout will be shared with you.

Conclusion

To open an SBI tax-saving FD, one needs to do little things such as filling out the application form and submitting of application form with the KYC documents. Any branch can open your FD, irrespective of where you maintained your bank account.

There are many channels for opening SBI tax-saving FD too. One of the most preferred modes is online banking which lets you save time and energy. Both SBI YONO and the bank’s online website is functional. You may opt any one to complete the task.

Offline mode, you have to visit any branch an the bank employee will open the account in favour of you.